Financial Data Structures for Machine Learning Applications

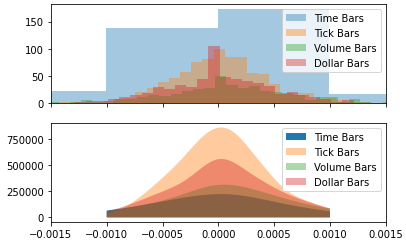

Today we will be exploring the financial data structures as discussed in Advances in Financial Machine Learning by Prof. Marcos Lopez de Prado [2018]. We will create four standard price and volume bars commonly used in financial machine learning within academic literature: time bars, tick bars, volume bars and dollar bars.

In this tutorial we are learning how to construct these standard bars in Python from raw trade information on a given product, here we are using Commonwealth Bank of Australia (CBA) equities trading information from my CommSec brokerage.