Implementation of a simple slow and fast binomial pricing model in python. We will treat binomial tree as a network with nodes (i,j) with i representing the time steps and j representing the number of ordered price outcome.

We will be implementing the following for the binomial_tree_slow algorithm, but it will work with the fast algorithm we made previously:

- Cox, Ross and Rubinstein (CRR)

- Jarrow and Rudd (JR)

- Equal probabilities (EQP)

- Trigeorgis (TRG)

Binomial Tree Representation

Stock tree can be represented using nodes (i,j) and intial stock price \(S_0\)

\(S_{i,j} = S_0u^{j}d^{i-j}\)

\(C_{i,j}\) represents contract price at each node (i,j). Where \(C_{N,j}\) represents final payoff function that we can define.

For this tutorial will will price a European Call, so \(C_{N,j} = max(S_{N,j}-K,0)\)

import numpy as np # Initialise parameters S0 = 100 # initial stock price K = 110 # strike price T = 0.5 # time to maturity in years r = 0.06 # annual risk-free rate N = 100 # number of time steps sigma = 0.3 # Annualised stock price volatility opttype = 'C' # Option Type 'C' or 'P'

Cox, Ross and Rubinstein (CRR) Method

Here we choose equal jump sizes

def CRR_method(K,T,S0,r,N,sigma,opttype='C'):

#precomute constants

dt = T/N

u = np.exp(sigma*np.sqrt(dt))

d = 1/u

q = (np.exp(r*dt) - d) / (u-d)

disc = np.exp(-r*dt)

# initialise asset prices at maturity - Time step N

S = np.zeros(N+1)

S[0] = S0*d**N

for j in range(1,N+1):

S[j] = S[j-1]*u/d

# initialise option values at maturity

C = np.zeros(N+1)

for j in range(0,N+1):

if opttype == 'C':

C[j] = max(0, S[j]-K)

else:

C[j] = max(0, K - S[j])

# step backwards through tree

for i in np.arange(N,0,-1):

for j in range(0,i):

C[j] = disc * ( q*C[j+1] + (1-q)*C[j] )

return C[0]

CRR_method(K,T,S0,r,N,sigma,opttype='C')

Jarrow and Rudd (JR) Method

Here we choose equal risk-neutral probabilities

def JR_method(K,T,S0,r,N,sigma,opttype='C'):

#precomute constants

dt = T/N

nu = r - 0.5*sigma**2

u = np.exp(nu*dt + sigma*np.sqrt(dt))

d = np.exp(nu*dt - sigma*np.sqrt(dt))

q = 0.5

disc = np.exp(-r*dt)

# initialise asset prices at maturity - Time step N

S = np.zeros(N+1)

S[0] = S0*d**N

for j in range(1,N+1):

S[j] = S[j-1]*u/d

# initialise option values at maturity

C = np.zeros(N+1)

for j in range(0,N+1):

if opttype == 'C':

C[j] = max(0, S[j]-K)

else:

C[j] = max(0, K - S[j])

# step backwards through tree

for i in np.arange(N,0,-1):

for j in range(0,i):

C[j] = disc * ( q*C[j+1] + (1-q)*C[j] )

return C[0]

JR_method(K,T,S0,r,N,sigma,opttype='C')

Equal Probabilities (EQP) Method

Here we choose equal risk-neutral probabilities, under logarithmic asset pricing tree

def EQP_method(K,T,S0,r,N,sigma,opttype='C'):

#precomute constants

dt = T/N

nu = r - 0.5*sigma**2

dxu = 0.5*nu*dt + 0.5*np.sqrt(4*sigma**2 * dt - 3*nu**2 * dt**2)

dxd = 1.5*nu*dt - 0.5*np.sqrt(4*sigma**2 * dt - 3*nu**2 * dt**2)

pu = 0.5

pd = 1-pu

disc = np.exp(-r*dt)

# initialise asset prices at maturity - Time step N

S = np.zeros(N+1)

S[0] = S0*np.exp(N*dxd)

for j in range(1,N+1):

S[j] = S[j-1]*np.exp(dxu - dxd)

# initialise option values at maturity

C = np.zeros(N+1)

for j in range(0,N+1):

if opttype == 'C':

C[j] = max(0, S[j]-K)

else:

C[j] = max(0, K - S[j])

# step backwards through tree

for i in np.arange(N,0,-1):

for j in range(0,i):

C[j] = disc * ( pu*C[j+1] + pd*C[j] )

return C[0]

EQP_method(K,T,S0,r,N,sigma,opttype='C')

Trigeorgis (TRG) Method

Here we choose equal jump sizes, under logarithmic asset pricing tree

def TRG_method(K,T,S0,r,N,sigma,opttype='C'):

#precomute constants

dt = T/N

nu = r - 0.5*sigma**2

dxu = np.sqrt(sigma**2 * dt + nu**2 * dt**2)

dxd = -dxu

pu = 0.5 + 0.5*nu*dt/dxu

pd = 1-pu

disc = np.exp(-r*dt)

# initialise asset prices at maturity - Time step N

S = np.zeros(N+1)

S[0] = S0*np.exp(N*dxd)

for j in range(1,N+1):

S[j] = S[j-1]*np.exp(dxu - dxd)

# initialise option values at maturity

C = np.zeros(N+1)

for j in range(0,N+1):

if opttype == 'C':

C[j] = max(0, S[j]-K)

else:

C[j] = max(0, K - S[j])

# step backwards through tree

for i in np.arange(N,0,-1):

for j in range(0,i):

C[j] = disc * ( pu*C[j+1] + pd*C[j] )

return C[0]

TRG_method(K,T,S0,r,N,sigma,opttype='C')

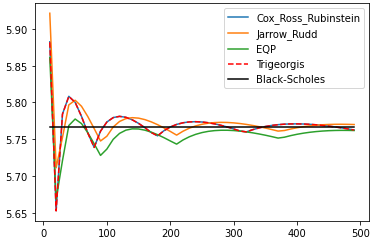

Comparision of Methods

Now we will compare convergence as function of time steps

from py_vollib.black_scholes import black_scholes as bs

import matplotlib.pyplot as plt

## call option with different steps

CRR, JR, EQP, TRG = [],[],[],[]

periods = range(10,500,10)

for N in periods:

CRR.append(CRR_method(K,T,S0,r,N,sigma,opttype='C'))

JR.append(JR_method(K,T,S0,r,N,sigma,opttype='C'))

EQP.append(EQP_method(K,T,S0,r,N,sigma,opttype='C'))

TRG.append(TRG_method(K,T,S0,r,N,sigma,opttype='C'))

BS = [bs('c', S0, K, T, r, sigma) for i in periods]

plt.plot(periods, CRR, label='Cox_Ross_Rubinstein')

plt.plot(periods, JR, label='Jarrow_Rudd')

plt.plot(periods, EQP, label='EQP')

plt.plot(periods, TRG, 'r--',label='Trigeorgis')

plt.plot(periods, BS, 'k',label='Black-Scholes')

plt.legend(loc='upper right')

plt.show()