In today’s tutorial we investigate how you can use ThetaData’s API to retreive historical options data for end-of-day, and both intraday trades and quotes. We will create volatility surfaces use an interpolation method (B-Splines) to compare surfaces between the morning (10am) implied volalitity and afternoon (2pm) implied volatility surfaces.

import os import time import pickle import numpy as np import pandas as pd import concurrent.futures as cf import matplotlib.pyplot as plt from datetime import timedelta, datetime, date from thetadata import ThetaClient, OptionReqType, OptionRight, DateRange, DataType

To use the ThetaData API you will have to sign up for an account. Then you will pass your username and password as strings within the ThetaClient class init params.

Get all Expirations for SPY Options

your_username = ''

your_password = ''

def get_expirations(root_ticker) -> pd.DataFrame:

"""Request expirations from a particular options root"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=15)

# Connect to the Terminal

with client.connect():

# Make the request

data = client.get_expirations(

root=root_ticker,

)

return data

root_ticker = 'SPY'

expirations = get_expirations(root_ticker)

root_ticker = 'SPY'

expirations = get_expirations(root_ticker)

exp_dates = expirations[expirations > time_now + timedelta(days=7)]

exp_dates

Get all Strikes for each SPY Option

def get_strikes(root_ticker, expiration_date) -> pd.DataFrame:

"""Request strikes from a particular option contract"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=15)

# Connect to the Terminal

with client.connect():

# Make the request

data = client.get_strikes(

root=root_ticker,

exp=expiration_date

)

return data

root_ticker = 'SPY'

exp_date = date(2022,9,16)

strikes = get_strikes(root_ticker, exp_date)

strikes

root_ticker = 'SPY'

all_strikes = {}

for exp_date in exp_dates:

all_strikes[exp_date] = pd.to_numeric(get_strikes(root_ticker, exp_date))

Find combined Strikes across expiry dates

Using set intersection of all strikes across SPY Options contracts.

Save strikes down with pickle for use later.

combined_strikes = [list(strikes) for strikes in all_strikes.values()]

vol_surface_strikes = set.intersection(*map(set,combined_strikes))

vol_surface_strikes

with open('vol_surface_strikes.pkl', 'wb') as f:

pickle.dump(vol_surface_strikes, f)

with open('vol_surface_strikes.pkl', 'rb') as f:

vol_surface_strikes = pickle.load(f)

vol_surface_strikes = list(vol_surface_strikes)

vol_surface_strikes.sort()

vol_surface_strikes

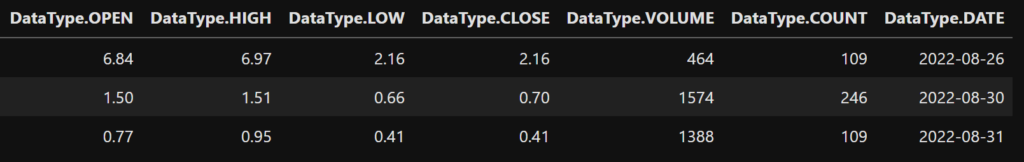

Retreive EOD Options Data

def end_of_day(root_ticker, exp_date, strike, from_date, to_date) -> pd.DataFrame:

"""Request end-of-day data"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=10)

# Connect to the Terminal

with client.connect():

# Make the request

data = client.get_hist_option(

req=OptionReqType.EOD,

root=root_ticker,

exp=exp_date,

strike=strike,

right=OptionRight.CALL,

date_range=DateRange(from_date, to_date),

)

return data

root_ticker = 'SPY'

from_date = date(2022,8,26)

to_date = date(2022,8,31)

exp_date = exp_dates.tolist()[0]

strike = 420000

data = end_of_day(root_ticker, exp_date, int(int(strike)/1000), from_date, to_date)

data

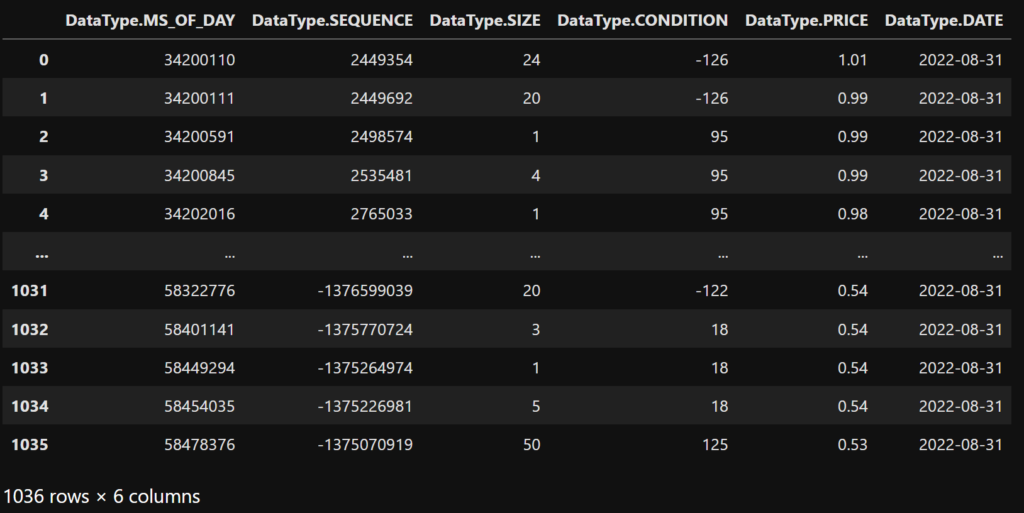

Retreive Trades Data

# Make the request

def trades(root_ticker, exp_date, strike, from_date, to_date) -> pd.DataFrame:

"""Request trade level data"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=10)

# Connect to the Terminal

with client.connect():

data = client.get_hist_option(

req=OptionReqType.TRADE,

root=root_ticker,

exp=exp_date,

strike=strike,

right=OptionRight.CALL,

date_range=DateRange(from_date, to_date),

progress_bar=False,

)

return data

root_ticker = 'SPY'

exp_date = date(2022,9,16)

from_date = date(2022,8,31)

to_date = date(2022,8,31)

strike = 420000

data = trades(root_ticker, exp_date, int(int(strike)/1000), from_date, to_date)

data

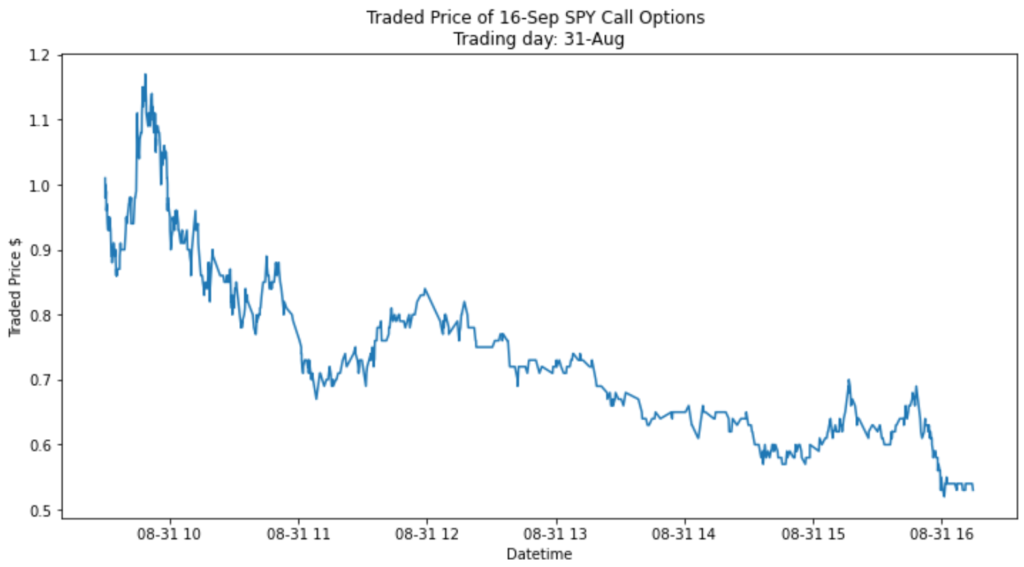

Use MS_OF_DAY to Create DateTime

data['DATETIME'] = data[DataType.DATE] + pd.TimedeltaIndex(data[DataType.MS_OF_DAY], unit='ms')

plt.figure(figsize=(12,6))

plt.title('Traded Price of 16-Sep SPY Call Options \n Trading day: 31-Aug ')

plt.xlabel('Datetime')

plt.ylabel('Traded Price $')

plt.plot(data['DATETIME'],data[DataType.PRICE])

Retreive Quoted Intraday Options Prices

# Make the request

def quotes(root_ticker, exp_date, strike, from_date, to_date, interval_size=0) -> pd.DataFrame:

"""Request quotes both bid/ask options data"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=10)

# Connect to the Terminal

with client.connect():

data = client.get_hist_option(

req=OptionReqType.QUOTE,

root=root_ticker,

exp=exp_date,

strike=strike,

right=OptionRight.CALL,

date_range=DateRange(from_date, to_date),

progress_bar=False,

interval_size=interval_size

)

return data

root_ticker = 'SPY'

exp_date = date(2022,9,16)

from_date = date(2022,8,31)

to_date = date(2022,8,31)

strike = 420000

data = quotes(root_ticker, exp_date, int(int(strike)/1000), from_date, to_date)

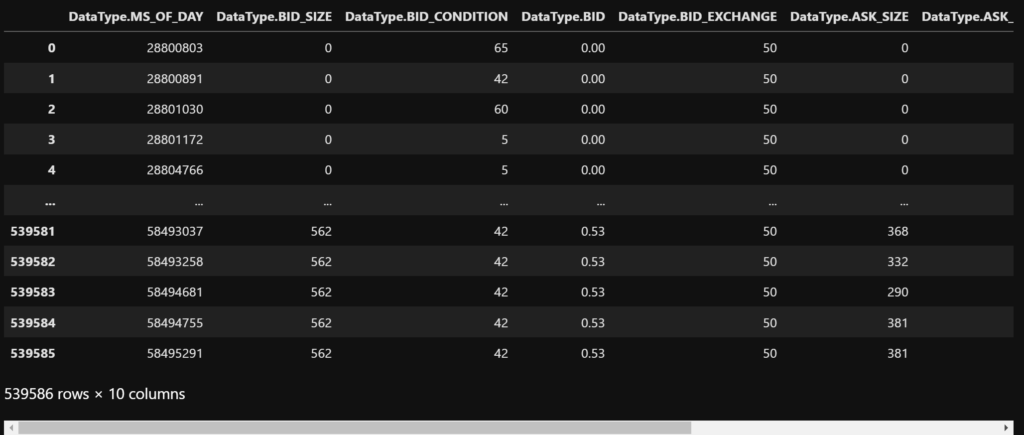

data

Change interval size

Aggregate average BID/ASK Quotes on a 5 minute basis.

interval_size = 5*60000

data = quotes(root_ticker, exp_date, int(int(strike)/1000), from_date, to_date, interval_size)

dt_date_ms = data[DataType.DATE] + pd.TimedeltaIndex(data[DataType.MS_OF_DAY], unit='ms')

data.insert(loc=0, column='DATETIME', value=dt_date_ms)

data

morning_int = 120

afternoon_int = 168

morning = data['DATETIME'][morning_int]

afternoon = data['DATETIME'][afternoon_int]

print("Morning Interval", morning, "\nAfternoon Interval", afternoon)

data.iloc[afternoon_int]

Calculate Weighted Mid Price (Micro-Price)

Calculate the weighted mid price (micro-price) for each row within our quotes dataframe.

$$\Large P_{m} = P_a \frac{V_b}{(V_a + V_b)} + P_b \frac{V_a}{(V_a + V_b)}$$

def weighted_mid_price(row):

try:

V_mid = row[DataType.ASK_SIZE] + row[DataType.BID_SIZE]

x_a = row[DataType.ASK_SIZE]/V_mid

x_b = 1 - x_a

return row[DataType.ASK]*x_a + row[DataType.BID]*x_b

except:

return np.nan

midprices = data.apply(weighted_mid_price, axis=1)

midprices

Create request for 10:00 and 14:00 Weighted Mid Prices

# Make the request

def get_morn_noon_quotes(root_ticker, exp_date, strike, from_date, to_date, interval_size=0) -> pd.DataFrame:

"""Returns morning and afternoon weighter mid prices at 1000 and 1400 respectively"""

# Create a ThetaClient

client = ThetaClient(username=your_username, passwd=your_password, timeout=10)

# Connect to the Terminal

with client.connect():

data = client.get_hist_option(

req=OptionReqType.QUOTE,

root=root_ticker,

exp=exp_date,

strike=strike,

right=OptionRight.CALL,

date_range=DateRange(from_date, to_date),

progress_bar=False,

interval_size=interval_size

)

morning_int = 120

afternoon_int = 168

midprices = data.apply(weighted_mid_price, axis=1)

return midprices[morning_int], midprices[afternoon_int]

Multi-threading Responses to ThetaData API

Now we explore using current.futures module to perform multi-threading and processing of responses using ThetaData API.

- We need to create a function that we can call with our specific parameters of interest

- We need to know the maximium number of threads our computer has

def retrieve_eod_data(root_ticker, exp_date, strike, from_date, to_date, interval_size):

try:

morning, afternoon = get_morn_noon_quotes(root_ticker, exp_date, int(int(strike)/1000), from_date, to_date, interval_size)

print(" ", strike," data")

datas[exp_date][strike] = [morning, afternoon]

except:

datas[exp_date][strike] = [np.nan, np.nan]

print(" ", strike," no data")

root_ticker = 'SPY'

from_date = date(2022,8,31)

to_date = date(2022,8,31)

interval_size = 5*60000

datas = {}

for exp_date in exp_dates:

print(exp_date)

start = time.time()

datas[exp_date] = {}

executor = cf.ThreadPoolExecutor(8)

futures = [executor.submit(retrieve_eod_data, root_ticker, exp_date, strike, from_date, to_date, interval_size)

for strike in vol_surface_strikes]

cf.wait(futures)

end = time.time()

print(' time taken {:.2f} s'.format(end-start))

Save Data Down with Pickle

with open('datas.pkl', 'wb') as f:

pickle.dump(datas, f)

Arrange data correctly in numpy array ready for calculating implied volatility.

with open('datas.pkl', 'rb') as f:

datas = pickle.load(f)

price_morn_arr = []

price_arvo_arr = []

for exp_date, prices in datas.items():

morn_arr = [price[0] for strike, price in sorted(prices.items())]

arvo_arr = [price[1] for strike, price in sorted(prices.items())]

# strikes = [strike for strike, price in sorted(prices.items())]

price_morn_arr.append(morn_arr)

price_arvo_arr.append(arvo_arr)

price_morn_arr = np.array(price_morn_arr)

price_arvo_arr = np.array(price_arvo_arr)

np.shape(price_morn_arr), price_morn_arr[0,:], np.shape(price_arvo_arr), price_arvo_arr[0,:]

Create DataFrame for Option Maturity, Strike and Prices

# !pip install py-vollib-vectorized from scipy.interpolate import griddata from py_vollib_vectorized import vectorized_implied_volatility as implied_vol maturity = np.array([(exp_date-time_now).days/365.25 for exp_date in exp_dates]) strikes = np.array(vol_surface_strikes)/1000 volSurfaceMorn = pd.DataFrame(price_morn_arr, index = maturity, columns = strikes) volSurfaceArvo = pd.DataFrame(price_arvo_arr, index = maturity, columns = strikes) volSurfaceLongMorn = volSurfaceMorn.melt(ignore_index=False).reset_index() volSurfaceLongArvo = volSurfaceArvo.melt(ignore_index=False).reset_index() volSurfaceLongMorn.columns = ['maturity', 'strike', 'price'] volSurfaceLongArvo.columns = ['maturity', 'strike', 'price'] s,m = np.meshgrid(strikes, maturity) np.shape(s) == np.shape(m) == np.shape(price_morn_arr) np.shape(m), m[:,0]

Interpolation of Price Surface

Using scipy griddata we can interpolate our multivariate price array and return a mesh for plotting.

strikes2 = np.linspace(strikes[0],strikes[-1],20)

maturity2 = np.linspace(maturity[0],maturity[-1],20)

s2,m2 = np.meshgrid(strikes2, maturity2)

price_intpol_morn = griddata((s[~np.isnan(price_morn_arr)], m[~np.isnan(price_morn_arr)]),

price_morn_arr[~np.isnan(price_morn_arr)], (s2,m2), method='linear')

price_intpol_arvo = griddata((s[~np.isnan(price_arvo_arr)], m[~np.isnan(price_arvo_arr)]),

price_arvo_arr[~np.isnan(price_arvo_arr)], (s2,m2), method='linear')

priceSurfaceMorn = pd.DataFrame(price_intpol_morn, index = maturity2, columns = strikes2)

priceSurfaceArvo = pd.DataFrame(price_intpol_arvo, index = maturity2, columns = strikes2)

priceSurfaceMorn = priceSurfaceMorn.melt(ignore_index=False).reset_index()

priceSurfaceArvo = priceSurfaceArvo.melt(ignore_index=False).reset_index()

priceSurfaceMorn.columns = ['maturity', 'strike', 'interpolation']

priceSurfaceArvo.columns = ['maturity', 'strike', 'interpolation']

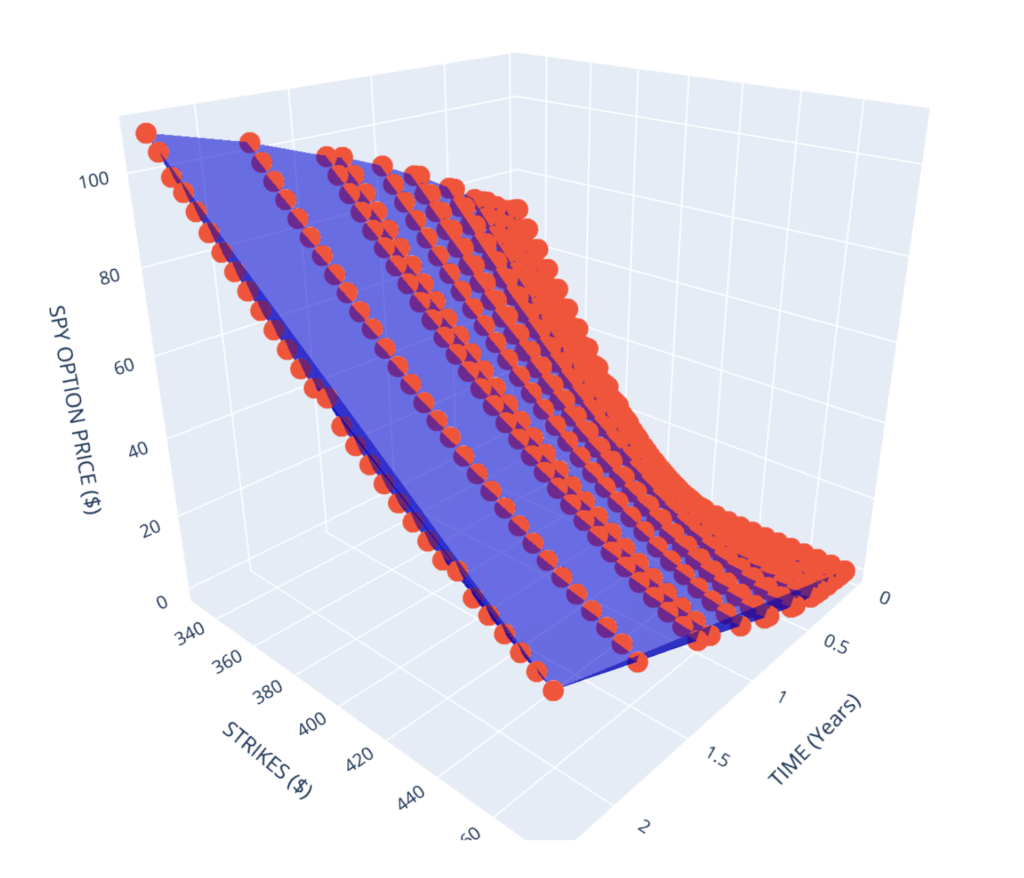

Using Plotly to graph 3D surface

First only looking at the Morning Price Surface

import plotly.graph_objects as go

from plotly.graph_objs import Surface

from plotly.offline import iplot, init_notebook_mode

init_notebook_mode()

fig = go.Figure(data=[go.Mesh3d(x=priceSurfaceMorn.maturity, y=priceSurfaceMorn.strike, z=priceSurfaceMorn.interpolation, color='mediumblue', opacity=0.55)])

fig.add_scatter3d(x=volSurfaceLongMorn.maturity, y=volSurfaceLongMorn.strike, z=volSurfaceLongMorn.price, mode='markers')

fig.update_layout(

title_text='10:00 SPY Quoted Market Prices (Markers) vs 2d Interpolation (Mesh)',

scene = dict(xaxis_title='TIME (Years)',

yaxis_title='STRIKES ($)',

zaxis_title='SPY OPTION PRICE ($)'),

height=800,

width=800

)

fig.show()

Plotting both the Morning and Afternoon Price Surfaces

import plotly.graph_objects as go

from plotly.graph_objs import Surface

from plotly.offline import iplot, init_notebook_mode

init_notebook_mode()

fig = go.Figure(data=[go.Mesh3d(x=priceSurfaceMorn.maturity, y=priceSurfaceMorn.strike, z=priceSurfaceMorn.interpolation, color='mediumblue', opacity=0.55),

go.Mesh3d(x=priceSurfaceArvo.maturity, y=priceSurfaceArvo.strike, z=priceSurfaceArvo.interpolation, color='red', opacity=0.55)])

# fig.add_scatter3d(x=volSurfaceLongMorn.maturity, y=volSurfaceLongMorn.strike, z=volSurfaceLongMorn.price, mode='markers')

fig.update_layout(

title_text='10:00 vs 14:00 SPY Quoted Market Prices (Markers) vs 2d Interpolation (Mesh)',

scene = dict(xaxis_title='TIME (Years)',

yaxis_title='STRIKES ($)',

zaxis_title='SPY OPTION PRICE ($)'),

height=800,

width=800

)

fig.show()

Calculation of Volatility Surface

Volatility array calculation from price_arr numpy array.

Create clean DataFrame for vol surface.

price_morn = 399.67 price_arvo = 396.75 s,m = np.meshgrid(strikes, maturity) volatility_morn = implied_vol(price_morn_arr, K=s, t=m, S=price_morn, r=0.01, flag='c', q=0, return_as='numpy', on_error='ignore') volatility_arvo = implied_vol(price_arvo_arr, K=s, t=m, S=price_arvo, r=0.01, flag='c', q=0, return_as='numpy', on_error='ignore') vol_morn_arr = np.copy(volatility_morn)*100 vol_arvo_arr = np.copy(volatility_arvo)*100 vol_morn_arr[(vol_morn_arr < 1) | (vol_morn_arr > 120)] = np.nan vol_arvo_arr[(vol_arvo_arr < 1) | (vol_arvo_arr > 120)] = np.nan volSurfaceLongMorn['volatility'] = vol_morn_arr volSurfaceLongArvo['volatility'] = vol_arvo_arr volSurfaceLongMorn = volSurfaceLongMorn[~( (np.isnan(volSurfaceLongMorn['price'])) | (volSurfaceLongMorn['volatility']) > 60)] volSurfaceLongArvo = volSurfaceLongArvo[~( (np.isnan(volSurfaceLongArvo['price'])) | (volSurfaceLongArvo['volatility']) > 60)] vol_morn_arr = vol_morn_arr.reshape(np.shape(price_morn_arr)) vol_arvo_arr = vol_arvo_arr.reshape(np.shape(price_arvo_arr)) vol_morn_arr[price_morn_arr == np.nan] = np.nan vol_arvo_arr[price_arvo_arr == np.nan] = np.nan vol_morn_arr[:,0], vol_arvo_arr[:,0]

Interpolation using Bivariate Spline

Interpolation of volatility array using scipy’s SmoothBivariateSpline.

import scipy.interpolate as interpolate s,m = s.flatten(),m.flatten() vol_morn_arr,price_morn_arr = vol_morn_arr.flatten(), price_morn_arr.flatten() vol_arvo_arr,price_arvo_arr = vol_arvo_arr.flatten(), price_arvo_arr.flatten() mask_morn = np.isnan(vol_morn_arr) mask_arvo = np.isnan(vol_arvo_arr) sm,mm,vol_morn_arr,price_morn_arr = s[~mask_morn],m[~mask_morn],vol_morn_arr[~mask_morn], price_morn_arr[~mask_morn] sa,ma,vol_arvo_arr,price_arvo_arr = s[~mask_arvo],m[~mask_arvo],vol_arvo_arr[~mask_arvo], price_arvo_arr[~mask_arvo] kx, ky = 4, 4 # spline order assert len(m) >= (kx+1)*(ky+1) wm=np.abs(price_morn_arr - price_morn)/price_morn * np.sqrt(mm) tck_morn = interpolate.SmoothBivariateSpline(mm, sm, vol_morn_arr, kx=kx, ky=ky, w=wm, bbox=[0, 5, 250, 650]) wa=np.abs(price_arvo_arr - price_arvo)/price_arvo * np.sqrt(ma) tck_arvo = interpolate.SmoothBivariateSpline(ma, sa, vol_arvo_arr, kx=kx, ky=ky, w=wa, bbox=[0, 5, 250, 650]) strikes2 = np.linspace(strikes[0],strikes[-1],20) maturity2 = np.linspace(maturity[0],maturity[-1],20) s2,m2 = np.meshgrid(strikes2, maturity2) vol_intpol_morn = tck_morn.ev(m2,s2) vol_intpol_arvo = tck_arvo.ev(m2,s2) # vol_intpol

Morning Volatility Surface Interpolation Displayed

Create DataFrame for plotting.

volSurfaceMorn2 = pd.DataFrame(vol_intpol_morn, index = maturity2, columns = strikes2)

volSurfaceLongMorn2 = volSurfaceMorn2.melt(ignore_index=False).reset_index()

volSurfaceLongMorn2.columns = ['maturity', 'strike', 'interpolation']

fig = go.Figure(data=[go.Mesh3d(x=volSurfaceLongMorn2.maturity, y=volSurfaceLongMorn2.strike, z=volSurfaceLongMorn2.interpolation, color='mediumblue', opacity=0.55)])

fig.add_scatter3d(x=volSurfaceLongMorn.maturity, y=volSurfaceLongMorn.strike, z=volSurfaceLongMorn.volatility, mode='markers')

fig.update_layout(

title_text='Market Implied Volatility (Markers) vs 2d Interpolation (Mesh)',

scene = dict(xaxis_title='TIME (Years)',

yaxis_title='STRIKES ($)',

zaxis_title='SPY IMPLIED VOL (%)'),

height=800,

width=800

)

fig.show()

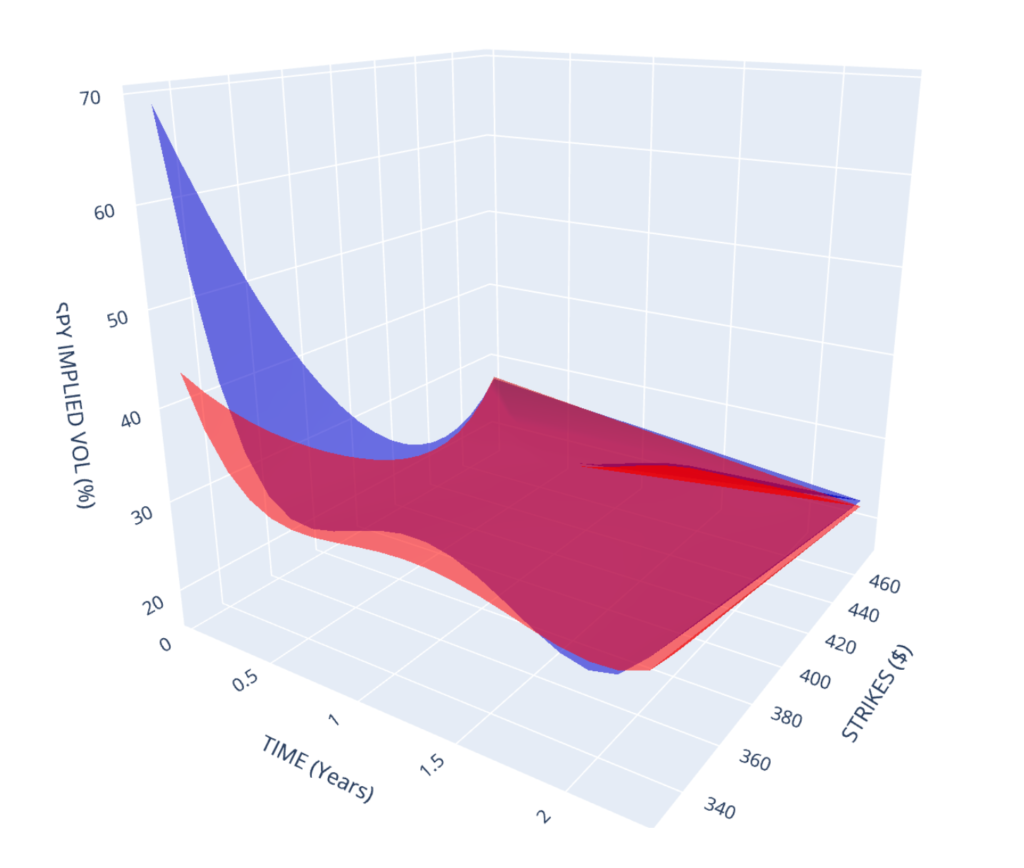

Morning vs Afternoon Vol Surfaces

volSurfaceArvo2 = pd.DataFrame(vol_intpol_arvo, index = maturity2, columns = strikes2)

volSurfaceLongArvo2 = volSurfaceArvo2.melt(ignore_index=False).reset_index()

volSurfaceLongArvo2.columns = ['maturity', 'strike', 'interpolation']

fig = go.Figure(data=[go.Mesh3d(x=volSurfaceLongMorn2.maturity, y=volSurfaceLongMorn2.strike, z=volSurfaceLongMorn2.interpolation, color='mediumblue', opacity=0.55, name='Morning'),

go.Mesh3d(x=volSurfaceLongArvo2.maturity, y=volSurfaceLongArvo2.strike, z=volSurfaceLongArvo2.interpolation, color='red', opacity=0.55, name='Afternoon')])

# fig.add_scatter3d(x=volSurfaceLongArvo.maturity, y=volSurfaceLongArvo.strike, z=volSurfaceLongArvo.volatility, mode='markers')

fig.update_layout(

title_text='SPY Intraday Vol Surfaces 10:00 vs 14:00',

scene = dict(xaxis_title='TIME (Years)',

yaxis_title='STRIKES ($)',

zaxis_title='SPY IMPLIED VOL (%)'),

height=800,

width=800,

showlegend=True,

)

fig.show()