This tutorial series is based off a article written by Backtrader https://www.backtrader.com/blog/2019-06-13-buy-and-hold/buy-and-hold/.

Here we will evaluate the difference between dollar cost averaging strategy and lump-sum investing. First, let’s import the dependencies and get the data in a format backtrader can use.

import datetime

import math

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from pandas_datareader import data as pdr

import backtrader as bt

# import data

def get_data(stocks, start, end):

stockData = pdr.get_data_yahoo(stocks, start, end)

return stockData

stockList = ['VTS.AX']

endDate = datetime.datetime.now()

startDate = endDate - datetime.timedelta(days=1800)

stockData = get_data(stockList[0], startDate, endDate)

actualStart = stockData.index[0]

data = bt.feeds.PandasData(dataname=stockData)

Next we have to define a valid strategy tha backtrader can interpret. This requires the following functions; start, nextstart and end.

class BuyAndHold(bt.Strategy):

def start(self):

self.val_start = self.broker.get_cash()

def nextstart(self):

size = math.floor( (self.broker.get_cash() - 10) / self.data[0] )

self.buy(size=size)

def stop(self):

# calculate actual returns

self.roi = (self.broker.get_value() / self.val_start) - 1

print('-'*50)

print('BUY & HOLD')

print('Starting Value: ${:,.2f}'.format(self.val_start))

print('ROI: {:.2f}%'.format(self.roi * 100.0))

print('Annualised: {:.2f}%'.format(100*((1+self.roi)**(365/(endDate-actualStart).days) -1)))

print('Gross Return: ${:,.2f}'.format(self.broker.get_value() - self.val_start))

BackTrader also requires a class to be defined in order to evaluate commission of each trade. This can be customised, example below for Fixed Commission Scheme.

lass FixedCommisionScheme(bt.CommInfoBase):

paras = (

('commission', 10),

('stocklike', True),

('commtype', bt.CommInfoBase.COMM_FIXED)

)

def _getcommission(self, size, price, pseudoexec):

return self.p.commission

Next we define a strategy to periodically (twice a month) buy $1,000 worth of the ETF. Here we have added logging functionality and are diving within the orders to ensure information is being calculated correctly by BackTrader.

class BuyAndHold_More_Fund(bt.Strategy):

params = dict(

monthly_cash=1000,

monthly_range=[5,20]

)

def __init__(self):

self.order = None

self.totalcost = 0

self.cost_wo_bro = 0

self.units = 0

self.times = 0

def log(self, txt, dt=None):

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def start(self):

self.broker.set_fundmode(fundmode=True, fundstartval=100.0)

self.cash_start = self.broker.get_cash()

self.val_start = 100.0

# ADD A TIMER

self.add_timer(

when=bt.timer.SESSION_START,

monthdays=[i for i in self.p.monthly_range],

monthcarry=True

# timername='buytimer',

)

def notify_timer(self, timer, when, *args):

self.broker.add_cash(self.p.monthly_cash)

target_value = self.broker.get_value() + self.p.monthly_cash - 10

self.order_target_value(target=target_value)

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

return

if order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price %.2f, Cost %.2f, Comm %.2f, Size %.0f' %

(order.executed.price,

order.executed.value,

order.executed.comm,

order.executed.size)

)

self.units += order.executed.size

self.totalcost += order.executed.value + order.executed.comm

self.cost_wo_bro += order.executed.value

self.times += 1

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

print(order.status, [order.Canceled, order.Margin, order.Rejected])

self.order = None

def stop(self):

# calculate actual returns

self.roi = (self.broker.get_value() / self.cash_start) - 1

self.froi = (self.broker.get_fundvalue() - self.val_start)

value = self.datas[0].close * self.units + self.broker.get_cash()

print('-'*50)

print('BUY & BUY MORE')

print('Time in Market: {:.1f} years'.format((endDate - actualStart).days/365))

print('#Times: {:.0f}'.format(self.times))

print('Value: ${:,.2f}'.format(value))

print('Cost: ${:,.2f}'.format(self.totalcost))

print('Gross Return: ${:,.2f}'.format(value - self.totalcost))

print('Gross %: {:.2f}%'.format((value/self.totalcost - 1) * 100))

print('ROI: {:.2f}%'.format(100.0 * self.roi))

print('Fund Value: {:.2f}%'.format(self.froi))

print('Annualised: {:.2f}%'.format(100*((1+self.froi/100)**(365/(endDate - actualStart).days) - 1)))

print('-'*50)

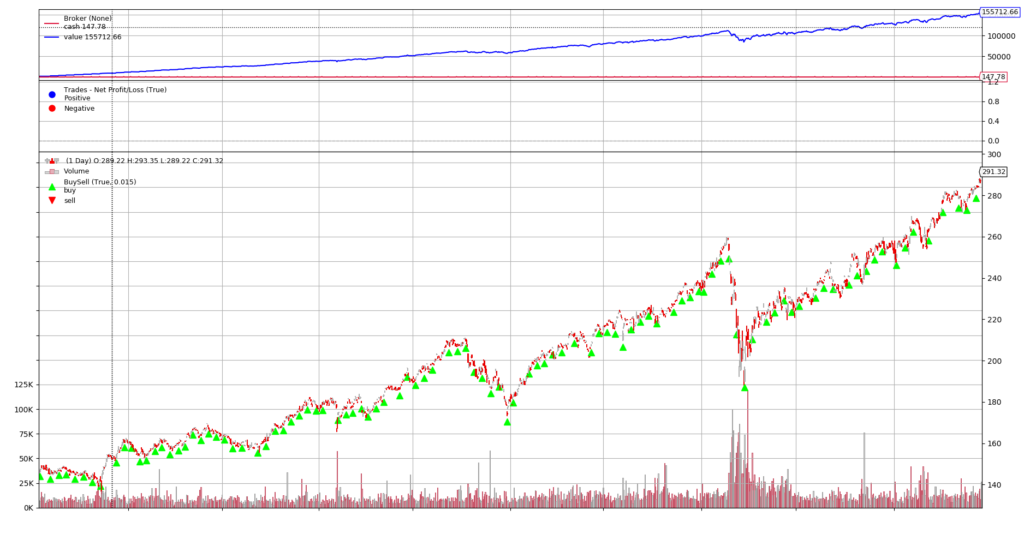

The final step to the puzzle is to define a run method that establishes BackTrader class Cerebro and adds in strategy, brokerage considerations and cash amount at the start of trading. Then you can run and plot results.

def run(data):

# BUY and HOLD

cerebro = bt.Cerebro()

cerebro.adddata(data)

cerebro.addstrategy(BuyAndHold)

# Broker Information

broker_args = dict(coc=True)

cerebro.broker = bt.brokers.BackBroker(**broker_args)

comminfo = FixedCommisionScheme()

cerebro.broker.addcommissioninfo(comminfo)

cerebro.broker.set_cash(100000)

# BUY and BUY MORE

cerebro1 = bt.Cerebro()

cerebro1.adddata(data)

cerebro1.addstrategy(BuyAndHold_More_Fund)

# Broker Information

broker_args = dict(coc=True)

cerebro1.broker = bt.brokers.BackBroker(**broker_args)

comminfo = FixedCommisionScheme()

cerebro1.broker.addcommissioninfo(comminfo)

cerebro1.broker.set_cash(1000)

cerebro1.run()

cerebro.run()

cerebro.plot(iplot=False, style='candlestick')

cerebro1.plot(iplot=False, style='candlestick')

if __name__ == '__main__':

run(data)