Implement Value at Risk & Conditional Value at Risk using:

- Historical Method

- Parametric Method (Variance-Covariance)

- Monte Carlo Method

Get the Historical Data

First let’s import the dependencies and get the data! We also assign random weightings to the given stock portfoio. Please feel free to change these weightings to whatever allocation you’d like!

import pandas as pd import numpy as np import datetime as dt from pandas_datareader import data as pdr from scipy.stats import norm, t import matplotlib.pyplot as plt

# Import data

def getData(stocks, start, end):

stockData = pdr.get_data_yahoo(stocks, start=start, end=end)

stockData = stockData['Close']

returns = stockData.pct_change()

meanReturns = returns.mean()

covMatrix = returns.cov()

return returns, meanReturns, covMatrix

# Portfolio Performance

def portfolioPerformance(weights, meanReturns, covMatrix, Time):

returns = np.sum(meanReturns*weights)*Time

std = np.sqrt( np.dot(weights.T, np.dot(covMatrix, weights)) ) * np.sqrt(Time)

return returns, std

stockList = ['CBA', 'BHP', 'TLS', 'NAB', 'WBC', 'STO']

stocks = [stock+'.AX' for stock in stockList]

endDate = dt.datetime.now()

startDate = endDate - dt.timedelta(days=800)

returns, meanReturns, covMatrix = getData(stocks, start=startDate, end=endDate)

returns = returns.dropna()

weights = np.random.random(len(returns.columns))

weights /= np.sum(weights)

returns['portfolio'] = returns.dot(weights)

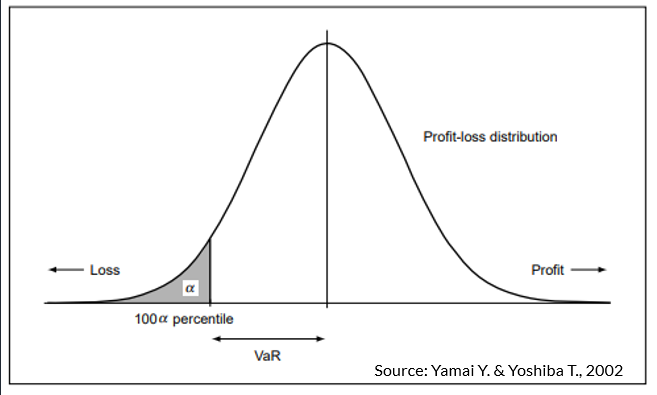

Historical VaR

Here we make no assumptions about the distribution of returns.

def historicalVaR(returns, alpha=5):

"""

Read in a pandas dataframe of returns / a pandas series of returns

Output the percentile of the distribution at the given alpha confidence level

"""

if isinstance(returns, pd.Series):

return np.percentile(returns, alpha)

# A passed user-defined-function will be passed a Series for evaluation.

elif isinstance(returns, pd.DataFrame):

return returns.aggregate(historicalVaR, alpha=alpha)

else:

raise TypeError("Expected returns to be dataframe or series")

def historicalCVaR(returns, alpha=5):

"""

Read in a pandas dataframe of returns / a pandas series of returns

Output the CVaR for dataframe / series

"""

if isinstance(returns, pd.Series):

belowVaR = returns <= historicalVaR(returns, alpha=alpha)

return returns[belowVaR].mean()

# A passed user-defined-function will be passed a Series for evaluation.

elif isinstance(returns, pd.DataFrame):

return returns.aggregate(historicalCVaR, alpha=alpha)

else:

raise TypeError("Expected returns to be dataframe or series")

# 100 days

Time = 100

hVaR = -historicalVaR(returns['portfolio'], alpha=5)*np.sqrt(Time)

hCVaR = -historicalCVaR(returns['portfolio'], alpha=5)*np.sqrt(Time)

pRet, pStd = portfolioPerformance(weights, meanReturns, covMatrix, Time)

InitialInvestment = 10000

print('Expected Portfolio Return: ', round(InitialInvestment*pRet,2))

print('Value at Risk 95th CI : ', round(InitialInvestment*hVaR,2))

print('Conditional VaR 95th CI : ', round(InitialInvestment*hCVaR,2))

Parametric VaR

Here we make an assumption on the distribution of returns abd use the historical portfolio returns and standard deviations (estimates) to define parameters for the model. Here we have implemented two parametric VaR models:

- normal distribution

- t-distribution (fatter tails)

def var_parametric(portofolioReturns, portfolioStd, distribution='normal', alpha=5, dof=6):

# because the distribution is symmetric

if distribution == 'normal':

VaR = norm.ppf(1-alpha/100)*portfolioStd - portofolioReturns

elif distribution == 't-distribution':

nu = dof

VaR = np.sqrt((nu-2)/nu) * t.ppf(1-alpha/100, nu) * portfolioStd - portofolioReturns

else:

raise TypeError("Expected distribution type 'normal'/'t-distribution'")

return VaR

def cvar_parametric(portofolioReturns, portfolioStd, distribution='normal', alpha=5, dof=6):

if distribution == 'normal':

CVaR = (alpha/100)**-1 * norm.pdf(norm.ppf(alpha/100))*portfolioStd - portofolioReturns

elif distribution == 't-distribution':

nu = dof

xanu = t.ppf(alpha/100, nu)

CVaR = -1/(alpha/100) * (1-nu)**(-1) * (nu-2+xanu**2) * t.pdf(xanu, nu) * portfolioStd - portofolioReturns

else:

raise TypeError("Expected distribution type 'normal'/'t-distribution'")

return CVaR

normVaR = var_parametric(pRet, pStd)

normCVaR = cvar_parametric(pRet, pStd)

tVaR = var_parametric(pRet, pStd, distribution='t-distribution')

tCVaR = cvar_parametric(pRet, pStd, distribution='t-distribution')

print("Normal VaR 95th CI : ", round(InitialInvestment*normVaR,2))

print("Normal CVaR 95th CI : ", round(InitialInvestment*normCVaR,2))

print("t-dist VaR 95th CI : ", round(InitialInvestment*tVaR,2))

print("t-dist CVaR 95th CI : ", round(InitialInvestment*tCVaR,2))

Monte Carlo VaR & CVaR

In this section we use a Monte Carlo simulation of a stock portfolio and then use the functions for historical VaR and CVaR to calculate our risk parameters.

The main advantage here is we could define individual models/stock dynamics for individual assets. This can be very powerful!

# Monte Carlo Method

mc_sims = 400 # number of simulations

T = 100 #timeframe in days

meanM = np.full(shape=(T, len(weights)), fill_value=meanReturns)

meanM = meanM.T

portfolio_sims = np.full(shape=(T, mc_sims), fill_value=0.0)

initialPortfolio = 10000

for m in range(0, mc_sims):

# MC loops

Z = np.random.normal(size=(T, len(weights)))

L = np.linalg.cholesky(covMatrix)

dailyReturns = meanM + np.inner(L, Z)

portfolio_sims[:,m] = np.cumprod(np.inner(weights, dailyReturns.T)+1)*initialPortfolio

plt.plot(portfolio_sims)

plt.ylabel('Portfolio Value ($)')

plt.xlabel('Days')

plt.title('MC simulation of a stock portfolio')

plt.show()

def mcVaR(returns, alpha=5):

""" Input: pandas series of returns

Output: percentile on return distribution to a given confidence level alpha

"""

if isinstance(returns, pd.Series):

return np.percentile(returns, alpha)

else:

raise TypeError("Expected a pandas data series.")

def mcCVaR(returns, alpha=5):

""" Input: pandas series of returns

Output: CVaR or Expected Shortfall to a given confidence level alpha

"""

if isinstance(returns, pd.Series):

belowVaR = returns <= mcVaR(returns, alpha=alpha)

return returns[belowVaR].mean()

else:

raise TypeError("Expected a pandas data series.")

portResults = pd.Series(portfolio_sims[-1,:])

VaR = initialPortfolio - mcVaR(portResults, alpha=5)

CVaR = initialPortfolio - mcCVaR(portResults, alpha=5)

print('VaR ${}'.format(round(VaR,2)))

print('CVaR ${}'.format(round(CVaR,2)))

Comparison of each VaR & CVaR methods

print("\nVaR:")

print(' historical VaR 95th CI : ', round(InitialInvestment*hVaR,2))

print(" Normal VaR 95th CI : ", round(InitialInvestment*normVaR,2))

print(" t-dist VaR 95th CI : ", round(InitialInvestment*tVaR,2))

print(" MC VaR 95th CI : ", round(VaR,2))

print("\nCVaR:")

print(' historical CVaR 95th CI : ', round(InitialInvestment*hCVaR,2))

print(" Normal CVaR 95th CI : ", round(InitialInvestment*normCVaR,2))

print(" t-dist CVaR 95th CI : ", round(InitialInvestment*tCVaR,2))

print(" MC CVaR 95th CI : ", round(CVaR,2))