Information Detection from Trade Data

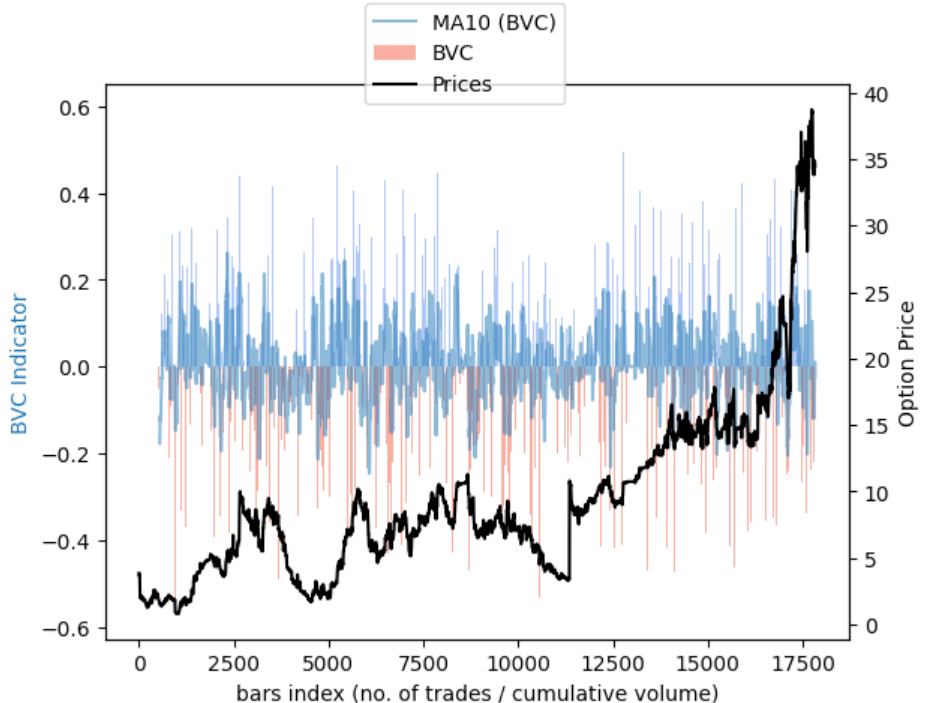

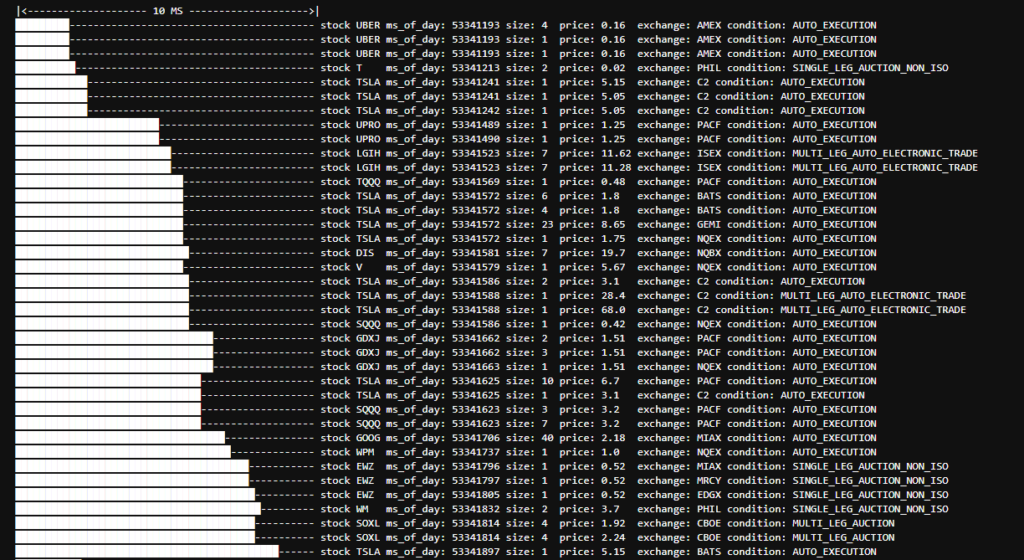

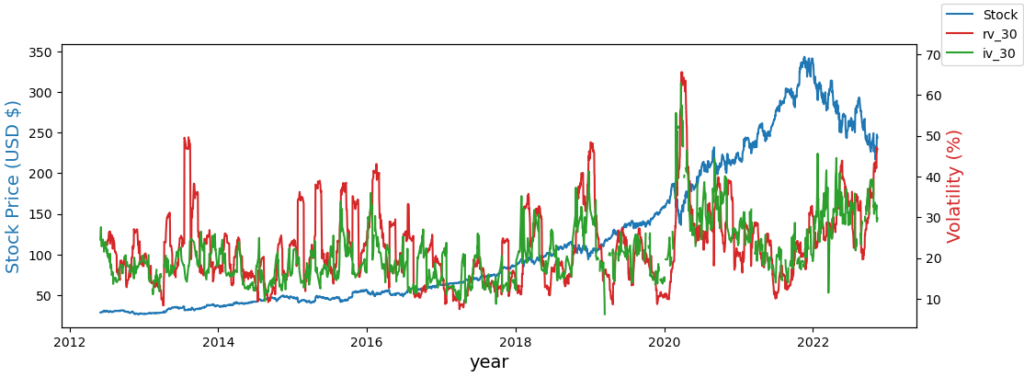

We will be implementing the bulk volume classification algorithm to attempt to discern information from tick by tick trade data. We will be using ThetaData’s API which provides both Historical and Real-time Streaming of Options Tick Level Data!