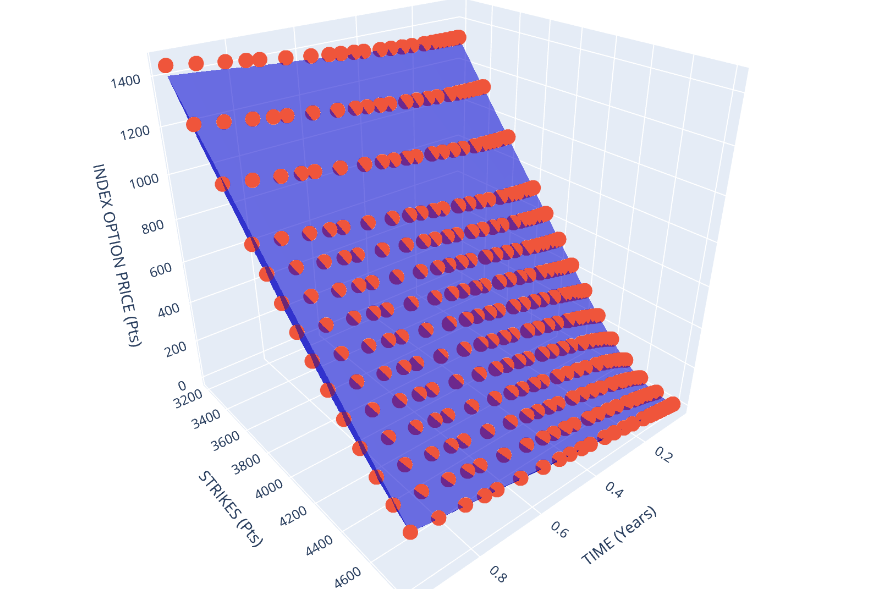

Heston Model Calibration to option prices

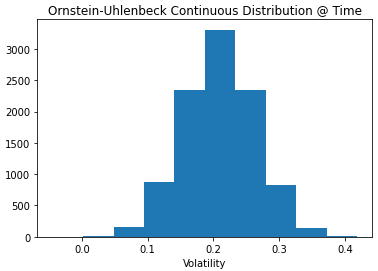

The Heston model is a useful model for simulating stochastic volatility and its effect on the potential paths an asset can take over the life of an option. It’s popular because of:

– easy closed-form solution for European option pricing

– no risk of negative variances

– incorporation of leverage effect

This allows for more effective modeling than the Black-Scholes formula allows due to its restrictive assumption of constant volatility.