European Spread Call Option with Stochastic Volatility

One of the main benefits of Monte Carlo simulations is to price options under multiple factors. By this I refer to multiple underlying asset prices or stochastic volatility or even changing interest rates.

In this tutorial we will explore the pricing of a European Spread Call Option on the difference between two stock indices \(S_1\) and \(S_2\) following a more general stochastic process. The SDE’s will be have stochastic volatility as described by the Heston Model (1993):

Underlying SDE’s under risk-neutral measure:

\(\large dS_{1,t} = (r-\delta_1) S_{1,t} dt + \sqrt{v_{1,t}} S_{1,t} dW^\mathbb{Q}_{1,t}\)

\(\large dS_{2,t} = (r-\delta_2) S_{2,t} dt + \sqrt{v_{2,t}} S_{2,t} dW^\mathbb{Q}_{2,t}\)

Variance Process:

\(\large dv_{1,t} = \kappa_1 (\theta_2 – v_{1,t})dt + \sigma_1 \sqrt{v_{1,t}} dW^\mathbb{Q}_{3,t}\)

\(\large dv_{2,t} = \kappa_2 (\theta_2 – v_{2,t})dt + \sigma_2 \sqrt{v_{2,t}} dW^\mathbb{Q}_{4,t}\)

The Monte Carlo procedure is exactly the same for a spread call option except the correlation matrix between Wiener processes is larger, as in we have four correlated normal variates to simulate the four processes.

Where:

\(\large \rho_{W^\mathbb{Q}} = \begin{vmatrix}1 & \rho_{12} & \rho_{13} & \rho_{14} \\ \rho_{12} & 1 & \rho_{23} & \rho_{24} \\ \rho_{13} & \rho_{23} & 1 & \rho_{34} \\ \rho_{14} & \rho_{24} & \rho_{34} & 1 \notag\end{vmatrix} \)

Notation:

– \(S_t\) Equity spot price, financial index

– \(v_t\) Variance.

– \(C\) European call option price.

– \(K\) Strike price.

– \(W_{1,2}\) Standard Brownian movements.

– \(r\) Interest rate.

– \(\delta\) discrete dividend payment

– \(\kappa\) Mean reversion rate.

– \(\theta\) Long run variance.

– \(v_0\) Initial variance.

– \(\sigma\) Volatility of variance.

– \(\rho\) Correlation parameter.

– \(t\) Current date.

– \(T\) Maturity date.

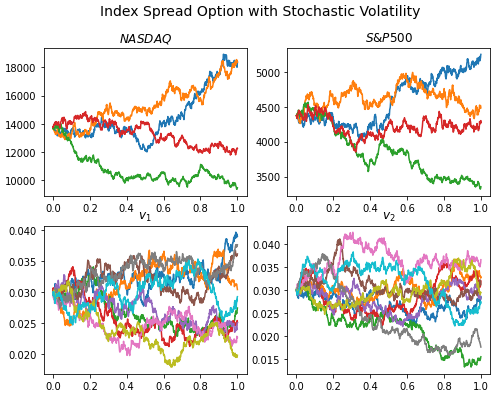

Example of Nasdaq vs S&P500 Index

A while back we discussed how to futures or options could be used to speculate on the divergence between the spread of the NASDAQ and S&P500 Indices. We follow on this example by incorperating stochastic volatility.

import numpy as np

from time import time

from scipy.linalg import cholesky

# Parameters - as of 1-Mar-22

SP500 = 4373.94

NASD = 13751.40

div_SP500 = 0.0127

div_NASD = 0.0126

K = 9377 # current difference between index points

T = 1

r = 0.01828 # 10yr US Treasury Bond Yield

# Heston Model Parameters - made up for the example,

# we have discussed how to complete this step in a previous video using market option prices

theta1 = 0.02

theta2 = 0.03

kappa1 = 0.1

kappa2 = 0.12

sigma1 = 0.05

sigma2 = 0.06

# initial variances

vt10 = 0.03

vt20 = 0.03

# Correlation matrix between wiener process under risk-neutral measure

rho = np.array([[1,0.5,0.15,0.02],

[0.5,1,0.01,0.25],

[0.15,0.01,1,0.2],

[0.02,0.25,0.2,1]])

Slow Implementation

Let’s first understand the implementation process

# Monte Carlo Specific Parameters

N = 100 # discrete time steps

M = 1000 # number of simulations

# Start Timer

start_time = time()

# Precompute constants

dt = T/N

# log normal prices

lnS1 = np.log(NASD)

lnS2 = np.log(SP500)

# Heston model adjustments for time steps

kappa1dt = kappa1*dt

kappa2dt = kappa2*dt

sigma1sdt = sigma1*np.sqrt(dt)

sigma2sdt = sigma2*np.sqrt(dt)

vt1 = vt10

vt2 = vt20

# Perform (lower) cholesky decomposition

lower_chol = cholesky(rho, lower=True)

# Standard Error Placeholders

sum_CT = 0

sum_CT2 = 0

# Monte Carlo Method

for i in range(M):

# for each simulation i in M

lnSt1 = lnS1

lnSt2 = lnS2

for j in range(N):

# for each time step j in N

# Generate correlated Wiener variables

Z = np.random.normal(0.0, 1.0, size=(4))

W = Z @ lower_chol

# Simulate variance processes

vt1 = vt1 + kappa1dt*(theta1 - vt1) + sigma1sdt*np.sqrt(vt1)*W[2]

vt2 = vt2 + kappa2dt*(theta2 - vt2) + sigma2sdt*np.sqrt(vt2)*W[3]

# Simulate log asset prices

nu1dt = (r - div_NASD - 0.5*vt1)*dt

nu2dt = (r - div_SP500 - 0.5*vt2)*dt

lnSt1 = lnSt1 + nu1dt + np.sqrt(vt1*dt)*W[0]

lnSt2 = lnSt2 + nu2dt + np.sqrt(vt2*dt)*W[1]

St1 = np.exp(lnSt1)

St2 = np.exp(lnSt2)

CT = max(0, (St1 - St2) - K)

sum_CT = sum_CT + CT

sum_CT2 = sum_CT2 + CT*CT

# Compute Expectation and SE

C0 = np.exp(-r*T)*sum_CT/M

sigma = np.sqrt( (sum_CT2 - sum_CT*sum_CT/M)*np.exp(-2*r*T) / (M-1) )

SE = sigma/np.sqrt(M)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0,2),np.round(SE,2)))

print("Calculation time: {0} sec".format(round(time() - start_time,2)))

Fast Implementation

Vectorizing option pricing

# Monte Carlo Specific Parameters

N = 100 # discrete time steps

M = 1000 # number of simulations

# Start Timer

start_time = time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappa1dt = kappa1*dt

kappa2dt = kappa2*dt

sigma1sdt = sigma1*np.sqrt(dt)

sigma2sdt = sigma2*np.sqrt(dt)

# Perform (lower) cholesky decomposition

lower_chol = cholesky(rho, lower=True)

# Generate correlated Wiener variables

Z = np.random.normal(0.0, 1.0, size=(N,M,4))

W = Z @ lower_chol

# arrays for storing prices and variances

lnSt1 = np.full(shape=(N+1,M), fill_value=np.log(NASD))

lnSt2 = np.full(shape=(N+1,M), fill_value=np.log(SP500))

vt1 = np.full(shape=(N+1,M), fill_value=vt10)

vt2 = np.full(shape=(N+1,M), fill_value=vt20)

for j in range(1,N+1):

# Simulate variance processes

vt1[j] = vt1[j-1] + kappa1dt*(theta1 - vt1[j-1]) + sigma1sdt*np.sqrt(vt1[j-1])*W[j-1,:,2]

vt2[j] = vt2[j-1] + kappa2dt*(theta2 - vt2[j-1]) + sigma2sdt*np.sqrt(vt2[j-1])*W[j-1,:,3]

# Simulate log asset prices

nu1dt = (r - div_NASD - 0.5*vt1[j])*dt

nu2dt = (r - div_SP500 - 0.5*vt2[j])*dt

lnSt1[j] = lnSt1[j-1] + nu1dt + np.sqrt(vt1[j]*dt)*W[j-1,:,0]

lnSt2[j] = lnSt2[j-1] + nu2dt + np.sqrt(vt2[j]*dt)*W[j-1,:,1]

St1 = np.exp(lnSt1)

St2 = np.exp(lnSt2)

# Compute Expectation and SE

CT = np.maximum(0, (St1[-1] - St2[-1]) - K)

C0 = np.exp(-r*T)*np.sum(CT)/M

sigma = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0)**2) / (M-1) )

SE= sigma/np.sqrt(M)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0,2),np.round(SE,2)))

print("Calculation time: {0} sec".format(round(time() - start_time,2)))

Visualisation

import matplotlib.pyplot as plt

t = np.linspace(0,1,len(St1))

fig, ax = plt.subplots(nrows=2, ncols=2, figsize=(8,6))

ax[0,0].plot(t,St1[:,:4])

ax[0,0].set_title('$NASDAQ$')

ax[0,1].plot(t,St2[:,:4])

ax[0,1].set_title('$S&P500$')

ax[1,0].plot(t,vt1[:,:10])

ax[1,0].set_title('$v_1$')

ax[1,1].plot(t,vt2[:,:10])

ax[1,1].set_title('$v_2$')

fig.suptitle("Index Spread Option with Stochastic Volatility", fontsize=14)

plt.show()