Path-Dependent Options – Lookback Options

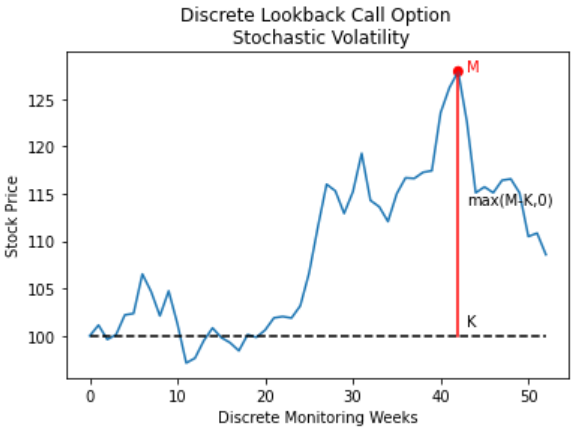

In this example we are pricing a discretely monitored lookback call option with stochastic volatility. The option payoffs are dependent on the extreme values, maximum or minimum, of the underlying asset prices over a certain time period (lookback period). There are two standard lookback options: fixed strike and floating strike. Fixed strike lookback option options pay the difference (if positive) between the max (\(M_0^T\)) or min (\(m_0^T\)) of a set of observations, over a lookback period \([0,T]\) of the asset price \(S_{t_i}\) and the strike price \(K\) at the maturity date \(T\).

For an Fixed Strike Lookback Call Options: \(C_T = max(0, M_0^T – K)\)

For an Fixed Strike Lookback Put Options: \(C_T = max(0, K – m_0^T)\)

Where:

- \(M_0^T = max(S_{t_i} : i = 1,…,N)\)

- \(m_0^T = min(S_{t_i} : i = 1,…,N)\)

Heston Model for Stochastic Volatility

Underlying SDE’s under risk-neutral measure:

\(dS_{t} = (r-\delta) S_{t} dt + \sqrt{v_{t}} S_{t} dW^\mathbb{Q}_{1,t}\)

Variance Process:

\(dv_{t} = \kappa (\theta – v_{t})dt + \sigma \sqrt{v_{t}} dW^\mathbb{Q}_{2,t}\) \(\rho^\mathbb{Q} dt=dW^\mathbb{Q}{1,t} dW^\mathbb{Q}{2,t}\) Let’s assume no correlation or \(\rho = 0\)

# Import dependencies import time import numpy as np import pandas as pd from scipy.stats import norm from datetime import datetime import matplotlib.pyplot as plt

# Initialise parameters S0 = 100.0 # initial stock price K = 100 # strike price T = 1.0 # time to maturity in years r = 0.06 # annual risk-free rate vol = 0.20 # volatility (%) div = 0.03 # continuous dividend yield # Heston parameters kappa = 5.0 vt0 = vol**2 # variance theta = 0.2**2 sigma = 0.02

Slow Solution – Steps

# slow steps

N = 52 # number of time intervals

M = 1000 # number of simulations

start_time = time.time()

# Assume evenly spaced discrete lookback

dt = T/N

# Precompute constants

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Standard Error Placeholders

sum_CT = 0

sum_CT2 = 0

# Monte Carlo Method

for i in range(M):

St = S0

vt = vt0

St_max = S0

for j in range(N):

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(2))

# variance process

vt = vt + kappadt*(theta-vt) + sigmasdt*np.sqrt(vt)*W[0]

# asset process

St = St*np.exp( (r-div-0.5*vt)*dt + np.sqrt(vt*dt)*W[1])

if St > St_max:

St_max = St

CT = max(0, St_max - K)

# print(CT)

sum_CT = sum_CT + CT

sum_CT2 = sum_CT2 + CT*CT

# Compute Expectation and SE

C0_slow = np.exp(-r*T)*sum_CT/M

SE_slow = np.sqrt( (sum_CT2 - sum_CT*sum_CT/M)*np.exp(-2*r*T) / (M-1) ) / np.sqrt(M)

time_comp_slow = round(time.time() - start_time,4)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0_slow,3),np.round(SE_slow,3)))

print("Computation time is: ", time_comp_slow)

Fast Implementation – Vectorized with Numpy

# fast steps

N = 52 # number of time intervals

M = 1000 # number of simulations

# Start Timer

start_time = time.time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(N,M,2))

# arrays for storing prices and variances

St = np.full(shape=(N+1,M), fill_value=S0)

vt = np.full(shape=(N+1,M), fill_value=vt0)

# array for storing maximum's

St_max = np.full(shape=(M), fill_value=S0)

for j in range(1,N+1):

# Simulate variance processes

vt[j] = vt[j-1] + kappadt*(theta - vt[j-1]) + sigmasdt*np.sqrt(vt[j-1])*W[j-1,:,0]

# Simulate log asset prices

nudt = (r - div - 0.5*vt[j])*dt

St[j] = St[j-1]*np.exp( nudt + np.sqrt(vt[j]*dt)*W[j-1,:,1] )

mask = np.where(St[j] > St_max)

St_max[mask] = St[j][mask]

# Compute Expectation and SE

CT = np.maximum(0, St_max - K)

C0_fast = np.exp(-r*T)*np.sum(CT)/M

SE_fast = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0_fast)**2) / (M-1) ) /np.sqrt(M)

time_comp_fast = round(time.time() - start_time,4)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0_fast,2),np.round(SE_fast,2)))

print("Computation time is: ", time_comp_fast)

Variation Reduction Comparison

Antithetic

# Start Timer

start_time = time.time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(N,M,2))

# arrays for storing prices and variances

St1 = np.full(shape=(N+1,M), fill_value=S0)

St2 = np.full(shape=(N+1,M), fill_value=S0)

vt = np.full(shape=(N+1,M), fill_value=vt0)

# array for storing maximum's

St1_max = np.full(shape=(M), fill_value=S0)

St2_max = np.full(shape=(M), fill_value=S0)

for j in range(1,N+1):

# Simulate variance processes

vt[j] = vt[j-1] + kappadt*(theta - vt[j-1]) + sigmasdt*np.sqrt(vt[j-1])*W[j-1,:,0]

# Simulate log asset prices

nudt = (r - div - 0.5*vt[j])*dt

St1[j] = St1[j-1]*np.exp( nudt + np.sqrt(vt[j]*dt)*W[j-1,:,1] )

St2[j] = St2[j-1]*np.exp( nudt - np.sqrt(vt[j]*dt)*W[j-1,:,1] )

mask1 = np.where(St1[j] > St1_max)

mask2 = np.where(St2[j] > St2_max)

St1_max[mask1] = St1[j][mask1]

St2_max[mask2] = St2[j][mask2]

# Compute Expectation and SE

CT = 0.5 * ( np.maximum(0, St1_max - K) + np.maximum(0, St2_max - K) )

C0_av = np.exp(-r*T)*np.sum(CT)/M

SE_av = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0_av)**2) / (M-1) ) /np.sqrt(M)

time_comp_av = round(time.time() - start_time,4)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0_av,2),np.round(SE_av,2)))

print("Calculation time: {0} sec".format(time_comp_av))

Analytical Solution for Continuous Observations

There is no analytical solution for the price of European fixed strike lookback call options with discrete fixings and stochastic volatility under Heston model. However there is a simple analytical formula for the price of a continuously monitored (fixing) fixed strike lookback call with constant volatility.

\(C_{FIXED \ STRIKE \ LOOKBACK \ CALL} = G + Se^{-\delta T}N(x+\sigma\sqrt{T})- Ke^{-rT}N(x) – \frac{S}{B}(e^{-rT}(\frac{E}{S})^B N(x+(1-B)\sigma \sqrt{T}) – e^{-\delta T}N(x+\sigma\sqrt{T}))\)

Where:

\(B = \frac{2(r-\delta)}{\sigma^2}\)

\(x = \frac{ln(\frac{S}{E}) + ((r-\delta)-\frac{1}{2}\sigma^2)T}{\sigma\sqrt{T}}\)

\(\left\lbrace

\begin{array}{ c l }

E=K, G=0 & \quad \textrm{if } K \geq M \

E=M, G=e^{-rt}(M-K) & \quad \textrm{otherwise}

\end{array}

\right.\)

class fixed_strike_lookback_call:

def __init__(self, r, S, K, T, M, vol, div=0):

self.r = r

self.S = S

self.K = K

self.T = T

self.M = M

self.vol = vol

self.div = div

def option_price_vectorized(self):

"Calculate fixed strike lookback call price of call/put"

E = np.where(self.K < self.M, self.M, self.K)

G = np.where(self.K < self.M, np.exp(-self.r*self.T)*(self.M-self.K), 0)

x = (np.log(self.S/E) + ((self.r-self.div) - self.vol**2/2)*self.T)/(self.vol*np.sqrt(self.T))

B = 2*(self.r-self.div)/(self.vol**2)

price = G + self.S*np.exp(-self.div*T)*norm.cdf(x+self.vol*np.sqrt(self.T), 0, 1) \

- self.K*np.exp(-self.r*self.T)*norm.cdf(x) \

- self.S/B*(np.exp(-self.r*self.T)*(E/self.S)**B * norm.cdf(x+(1-B)*self.vol*np.sqrt(self.T)) \

- np.exp(-self.div*self.T)*norm.cdf(x+self.vol*np.sqrt(self.T), 0, 1))

return price

def option_price_fd(self, S, vol):

"Calculate fixed strike lookback call price of call/put"

if self.K < self.M:

E = self.M

G = np.exp(-self.r*self.T)*(self.M-self.K)

else:

E = self.K

G = 0

x = (np.log(S/E) + ((self.r-self.div) - vol**2/2)*self.T)/(vol*np.sqrt(self.T))

B = 2*(self.r-self.div)/(vol**2)

price = G + S*np.exp(-self.div*T)*norm.cdf(x+vol*np.sqrt(self.T), 0, 1) \

- self.K*np.exp(-self.r*self.T)*norm.cdf(x) \

- S/B*(np.exp(-self.r*self.T)*(E/S)**B * norm.cdf(x+(1-B)*vol*np.sqrt(self.T)) \

- np.exp(-self.div*self.T)*norm.cdf(x+vol*np.sqrt(self.T), 0, 1))

return price

def option_price_fd_vectorized(self, S, vol):

"Calculate fixed strike lookback call price of call/put"

E = np.where(self.K < self.M, self.M, self.K)

G = np.where(self.K < self.M, np.exp(-self.r*self.T)*(self.M-self.K), 0)

x = (np.log(S/E) + ((self.r-self.div) - vol**2/2)*self.T)/(vol*np.sqrt(self.T))

B = 2*(self.r-self.div)/(vol**2)

price = G + S*np.exp(-self.div*T)*norm.cdf(x+vol*np.sqrt(self.T), 0, 1) \

- self.K*np.exp(-self.r*self.T)*norm.cdf(x) \

- S/B*(np.exp(-self.r*self.T)*(E/S)**B * norm.cdf(x+(1-B)*vol*np.sqrt(self.T)) \

- np.exp(-self.div*self.T)*norm.cdf(x+vol*np.sqrt(self.T), 0, 1))

return price

def FD_S(self, S):

vol = self.vol

return self.option_price_fd_vectorized(S, vol)

def FD_vol(self, vol):

S = self.S

return self.option_price_fd_vectorized(S, vol)

def delta_fd(self, delta=0.001):

deltaS = delta*self.S

return (self.FD_S(self.S+deltaS)-self.FD_S(self.S-deltaS)) / (2*deltaS)

def gamma_fd(self, delta=0.001):

deltaS = delta*self.S

return (self.FD_S(self.S+deltaS)-2*self.FD_S(self.S)+self.FD_S(self.S-deltaS)) / (deltaS**2)

def vega_fd(self, delta=0.001):

deltaV = delta*self.vol

return (self.FD_vol(self.vol+deltaV)-self.FD_vol(self.vol-deltaV))/(2*deltaV)

cont_call = fixed_strike_lookback_call(r, S0, K, T, S0, vol, div)

print("Option Price: ", round(cont_call.option_price_vectorized(),3))

print("Delta: ", round(cont_call.delta_fd(),3))

print("Gamma: ", round(cont_call.gamma_fd(),3))

print("Vega: ", round(cont_call.vega_fd(),3))

ContPrice = cont_call.option_price_vectorized()

General Control Variate Equation

For J control variates we have:

\( \Large C_0\exp(rT) = C_T – \sum^J_{i=j}\beta_j cv_j + \eta\)

where

- \(\beta_j\) are factors to account for the “true” linear relationship between the option pay-off and the control variate \(cv_j\)

- \(\eta\) accounts for errors:

- discrete rebalancing

- approximations in hedge sensitivities (calc. delta / gamma)

Option price as the sum of the linear relationships with J control variates

\( \large C_T =\beta_0 + \sum^J_{i=j}\beta_j cv_j + \eta\)

where \(\beta_0 = C_0\exp(rT)\) is the forward price of the option

If we perform M simulations at discrete time intervals N we can regard the pay-offs and control variates as samples of the linear relationship with some noise. We can estimate the true relationship between control variates and option pay-offs with least-squares regression:

\(\beta = (X’X)^{-1}X’Y\)

We don’t want biased estimates of \(\beta_j\) so these should be precomputed by least-squares regression to establish the relationship between types of control variates and options first. These estaimates of \(\beta_j\) values can then be used for \(cv_j\) for pricing any option.

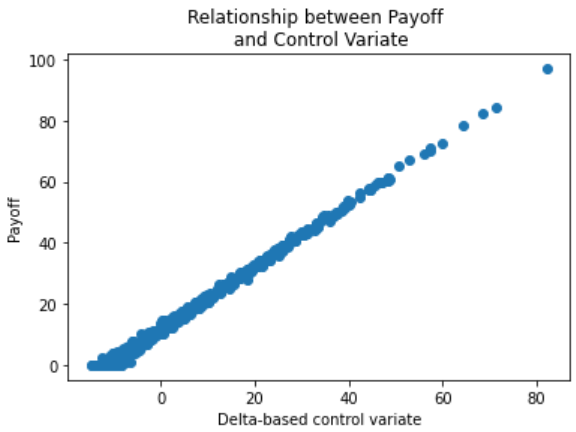

Implementation of Delta-based Control Variates

\(\large cv_1 = \sum^{N-1}{i=0} \frac{\delta C{t_i}}{\delta S}(S_{t_{i+1}} – {\mathbb E}[S_{t_i}])\exp{r(T-t_{i+1})}\)

\(\large C_{t_0}\exp{rT} = C_T + \beta_1 cv_1 + \eta\)

where with GBM dynamics:

- \({\mathbb E}[S_{t_{i+1}}] = S_{t_{i}} \exp (r \Delta t_i)\)

- \(\beta_1 = -1\) which is the appropriate value where we have exact delta for European Option

# fast steps

N = 52 # number of time intervals

M = 1000 # number of simulations

def delta_calc(r, S, K, T, sigma, type="c"):

"Calculate delta of an option"

d1 = (np.log(S/K) + (r + sigma**2/2)*T)/(sigma*np.sqrt(T))

try:

if type == "c":

delta_calc = norm.cdf(d1, 0, 1)

elif type == "p":

delta_calc = -norm.cdf(-d1, 0, 1)

return delta_calc

except:

print("Please confirm option type, either 'c' for Call or 'p' for Put!")

S = S0

#precompute constants

dt = T/N

nudt = (r - 0.5*vol**2)*dt

volsdt = vol*np.sqrt(dt)

erdt = np.exp(r*dt)

cv = 0

beta1 = -1

# Monte Carlo Method

Z = np.random.normal(size=(N, M))

delta_St = nudt + volsdt*Z

ST = S*np.cumprod( np.exp(delta_St), axis=0)

ST = np.concatenate( (np.full(shape=(1, M), fill_value=S), ST ) )

deltaSt = delta_calc(r, ST[:-1].T, K, np.linspace(T,dt,N), vol, "c").T

cv = np.cumsum(deltaSt*(ST[1:] - ST[:-1]*erdt), axis=0)

Y = np.maximum(0, ST[-1] - K)

plt.scatter(cv[-1],Y)

plt.title('Relationship between Payoff \n and Control Variate')

plt.ylabel('Payoff')

plt.xlabel('Delta-based control variate')

plt.show()

Least-Squares Regression

Find “True” relationship between control variate hedges and payoff.

X = np.vstack([np.ones(M), cv[-1]]).T

beta = np.linalg.lstsq(X, Y, rcond=1)[0]

print('Beta 0 (fair value T=0): ', round(beta[0],3))

print('Beta 1 (delta) : ', round(beta[1],3))

Gamma Based Control Variate

The control variate is a random variable whose expected value we know, which is correlated with the varaible we are trying to estimate.

In the same way as for \(cv_1\) we can create other control variates, which are equivalent to other hedges.

For example a gamma-based control variate (\(cv_2\)):

\(\large cv_2 = \sum^{N-1}{i=0} \frac{\delta^2 C{t_i}}{\delta S^2}((\Delta S_{t_{i+1}})^2 – {\mathbb E}[(\Delta S_{t_i})^2])\exp{r(T-t_{i+1})}\)

Where \({\mathbb E}[(\Delta S_{t_i})^2] = S_{t_i}^2 (\exp([2r+\sigma^2]\Delta t_i)-2\exp(r\Delta t_i)+1)\)

# Initialise parameters

S0 = 100.0 # initial stock price

K = 100 # strike price

T = 1.0 # time to maturity in years

r = 0.06 # annual risk-free rate

vol = 0.20 # volatility (%)

div = 0.03 # continuous dividend yield

M = 100

# Heston parameters

kappa = 5.0

vt0 = vol**2 # variance

theta = 0.2**2

sigma = 0.02

# fast steps

N = 52 # number of time intervals

M = 10000 # number of simulations

# Start Timer

start_time = time.time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Control variate constant terms

nudt = (r - div - 0.5*vt0)*dt

volsdt = np.sqrt(vt0*dt)

erddt = np.exp((r-div)*dt)

egam1 = np.exp(2*(r-div)*dt)

egam2 = -2*erddt + 1

eveg1 = np.exp(-kappadt)

eveg2 = theta - theta*eveg1

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(N,M,2))

# initialise prices and variances

vt = np.full(shape=(M), fill_value=vt0)

St = np.full(shape=(M), fill_value=S0)

vtn = np.full(shape=(M), fill_value=0.0)

Stn = np.full(shape=(M), fill_value=0.0)

# array for storing maximum's

St_max = np.full(shape=(M), fill_value=S0)

# array for storing control variates

cv1 = np.full(shape=(M), fill_value=0.0)

cv2 = np.full(shape=(M), fill_value=0.0)

cv3 = np.full(shape=(M), fill_value=0.0)

for j in range(1,N+1):

# Compute hedge sensitivities

call = fixed_strike_lookback_call(r, St, K, T-(j-1)*dt, St_max, np.sqrt(vt), div)

delta = call.delta_fd()

gamma = call.gamma_fd()

vega = call.vega_fd()

# Simulate variance processes

vtn = vt + kappadt*(theta - vt) + sigmasdt*np.sqrt(vt)*W[j-1,:,0]

# Simulate log asset prices

nudt = (r - div - 0.5*vt)*dt

Stn = St*np.exp( nudt + np.sqrt(vt*dt)*W[j-1,:,1] )

# accumulate control variates

cv1 += delta*(Stn - St*erddt)

cv2 += gamma*((Stn - St)**2 - (egam1*np.exp(vt*dt) + egam2)*St**2)

cv3 += vega*((vtn - vt) - (vt*eveg1+eveg2-vt))

mask = np.where(Stn > St_max)

St_max[mask] = Stn[mask]

vt = vtn

St = Stn

# Compute Expectation and SE

Y = np.maximum(0, St_max - K)

C0 = np.exp(-r*T)*np.sum(Y)/M

C0

X = np.vstack([np.ones(M), cv1, cv2, cv3]).T

beta = np.linalg.lstsq(X, Y, rcond=None)[0]

print('Beta 0 : ',round(beta[0],3))

print('Beta 1 (delta): ',round(beta[1],3))

print('Beta 2 (gamma): ',round(beta[2],3))

print('Beta 3 (vega) : ',round(beta[3],3))

fig, ax = plt.subplots(nrows=1, ncols=3, figsize=(14,4))

naming = ['Delta','Gamma','Vega']

ax[0].scatter(cv1,Y,label=naming[0],color='k')

ax[1].scatter(cv2,Y,label=naming[1],color='b')

ax[2].scatter(cv3,Y,label=naming[2],color='g')

for i,a in enumerate(ax):

a.set_ylabel('Payoff')

a.set_xlabel(naming[i]+'-based control variate')

a.legend()

plt.show()

# fast steps

N = 52 # number of time intervals

M = 1000 # number of simulations

# Start Timer

start_time = time.time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Control variate constant terms

erddt = np.exp((r-div)*dt)

egam1 = np.exp(2*(r-div)*dt)

egam2 = -2*erddt + 1

eveg1 = np.exp(-kappadt)

eveg2 = theta - theta*eveg1

# linear constants pre-determined for control variate weighting

beta1 = -beta[1]#-0.88

beta2 = -beta[2]#-0.43

beta3 = -beta[3]#-0.0003

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(N,M,2))

# arrays for storing prices and variances

St = np.full(shape=(N+1,M), fill_value=S0)

vt = np.full(shape=(N+1,M), fill_value=vt0)

# array for storing maximum's

St_max = np.full(shape=(M), fill_value=S0)

# array for storing control variates

cv1 = np.full(shape=(M), fill_value=0.0)

cv2 = np.full(shape=(M), fill_value=0.0)

cv3 = np.full(shape=(M), fill_value=0.0)

for j in range(1,N+1):

# Compute hedge sensitivities

call = fixed_strike_lookback_call(r, St[j-1], K, T-(j-1)*dt, St_max, np.sqrt(vt[j-1]), div)

delta = call.delta_fd()

gamma = call.gamma_fd()

vega = call.vega_fd()

# Simulate variance processes

vt[j] = vt[j-1] + kappadt*(theta - vt[j-1]) + sigmasdt*np.sqrt(vt[j-1])*W[j-1,:,0]

# Simulate log asset prices

nudt = (r - div - 0.5*vt[j])*dt

St[j] = St[j-1]*np.exp( nudt + np.sqrt(vt[j]*dt)*W[j-1,:,1] )

# accumulate control variates

cv1 += delta*(St[j] - St[j-1]*erddt)

cv2 += gamma*((St[j] - St[j-1])**2 - (egam1*np.exp(vt[j-1]*dt) + egam2)*St[j-1]**2)

cv3 += vega*((vt[j] - vt[j-1]) - (vt[j-1]*eveg1+eveg2-vt[j-1]))

mask = np.where(St[j] > St_max)

St_max[mask] = St[j][mask]

# Compute Expectation and SE

CT = np.maximum(0, St_max - K) + beta1*cv1 + beta2*cv2 + beta3*cv3

C0_cv = np.exp(-r*T)*np.sum(CT)/M

SE_cv = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0_cv)**2) / (M-1) ) /np.sqrt(M)

time_comp_cv = round(time.time() - start_time,4)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0_cv,2),np.round(SE_cv,2)))

print("Calculation time: {0} sec".format(time_comp_cv))

Antithetic and control Variate

# Start Timer

start_time = time.time()

# Precompute constants

dt = T/N

# Heston model adjustments for time steps

kappadt = kappa*dt

sigmasdt = sigma*np.sqrt(dt)

# Control variate constant terms

erddt = np.exp((r-div)*dt)

egam1 = np.exp(2*(r-div)*dt)

egam2 = -2*erddt + 1

eveg1 = np.exp(-kappadt)

eveg2 = theta - theta*eveg1

# linear constants pre-determined for control variate weighting

beta1 = -beta[1]#-0.88

beta2 = -beta[2]#-0.43

beta3 = -beta[3]#-0.0003

# Generate Wiener variables

W = np.random.normal(0.0, 1.0, size=(N,M,2))

# array for storing control variates

cv1 = np.full(shape=(M), fill_value=0.0)

cv2 = np.full(shape=(M), fill_value=0.0)

cv3 = np.full(shape=(M), fill_value=0.0)

# arrays for storing prices and variances

St1 = np.full(shape=(N+1,M), fill_value=S0)

St2 = np.full(shape=(N+1,M), fill_value=S0)

vt = np.full(shape=(N+1,M), fill_value=vt0)

# array for storing maximum's

St1_max = np.full(shape=(M), fill_value=S0)

St2_max = np.full(shape=(M), fill_value=S0)

for j in range(1,N+1):

# Compute hedge sensitivities

call1 = fixed_strike_lookback_call(r, St1[j-1], K, T-(j-1)*dt, St1_max, np.sqrt(vt[j-1]), div)

call2 = fixed_strike_lookback_call(r, St2[j-1], K, T-(j-1)*dt, St2_max, np.sqrt(vt[j-1]), div)

delta1 = call1.delta_fd()

delta2 = call2.delta_fd()

gamma1 = call1.gamma_fd()

gamma2 = call2.gamma_fd()

vega1 = call1.vega_fd()

vega2 = call2.vega_fd()

# Simulate variance processes

vt[j] = vt[j-1] + kappadt*(theta - vt[j-1]) + sigmasdt*np.sqrt(vt[j-1])*W[j-1,:,0]

# Simulate log asset prices

nudt = (r - div - 0.5*vt[j])*dt

St1[j] = St1[j-1]*np.exp( nudt + np.sqrt(vt[j]*dt)*W[j-1,:,1] )

St2[j] = St2[j-1]*np.exp( nudt - np.sqrt(vt[j]*dt)*W[j-1,:,1] )

# accumulate control variates

cv1 += delta1*(St1[j] - St1[j-1]*erddt) + delta2*(St2[j] - St2[j-1]*erddt)

cv2 += gamma1*((St1[j] - St1[j-1])**2 - (egam1*np.exp(vt[j-1]*dt) + egam2)*St1[j-1]**2) \

+ gamma2*((St2[j] - St2[j-1])**2 - (egam1*np.exp(vt[j-1]*dt) + egam2)*St2[j-1]**2)

cv3 += vega1*((vt[j] - vt[j-1]) - (vt[j-1]*eveg1+eveg2-vt[j-1])) \

+ vega2*((vt[j] - vt[j-1]) - (vt[j-1]*eveg1+eveg2-vt[j-1]))

mask1 = np.where(St1[j] > St1_max)

mask2 = np.where(St2[j] > St2_max)

St1_max[mask1] = St1[j][mask1]

St2_max[mask2] = St2[j][mask2]

# Compute Expectation and SE

CT = 0.5*(np.maximum(0, St1_max - K) + np.maximum(0, St2_max - K) \

+ beta1*cv1 + beta2*cv2 + beta3*cv3)

C0_acv = np.exp(-r*T)*np.sum(CT)/M

SE_acv = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0_acv)**2) / (M-1) ) /np.sqrt(M)

time_comp_acv = round(time.time() - start_time,4)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0_acv,2),np.round(SE_acv,2)))

print("Calculation time: {0} sec".format(time_comp_acv))

Comparing Variance Reduction Methods

C0_variates = [C0_slow, C0_fast, C0_av, C0_cv, C0_acv]

se_variates = [SE_slow, SE_fast, SE_av, SE_cv, SE_acv]

se_red = [round(SE_fast/se,2) for se in se_variates]

comp_time = [time_comp_slow, time_comp_fast, time_comp_av, time_comp_cv, time_comp_acv]

rel_time = [round(mc_time/time_comp_fast,2) for mc_time in comp_time]

data = {'Lookback Call Option Value': np.round(C0_variates,3),

'Standard Error SE': np.round(se_variates,3),

'SE Reduction Multiple': se_red,

'Relative Computation Time': rel_time}

# Creates pandas DataFrame.

df = pd.DataFrame(data, index =['Slow Estimate', 'Fast Estimate', 'with antithetic variate',

'with control variates', 'with antithetic and control variates'])

df