Beta weighting is a tool that allows us to approximate our positions in terms of the same benchmark. Today we learn how to beta weight your portfolio in python.

We will use three equivalent methods to estimate the beta coefficients of each security and then progress onto how you can beta weight your portfolio delta’s (the change in value given a unit change of the underlying) to get an approximation for how your portfolio will change with respect to a movement in your benchmark (whether it be a market index or specific security).

We will calculate beta coefficients directly using the capital asset pricing model (CAPM) definition, and through some linear algebra tools using linear regression on individual stocks and then aggregated using a closed form solution for linear regression with a specific minimisation function.

import datetime as dt import pandas as pd import numpy as np from scipy import stats from pandas_datareader import data as pdr

Specify date range for analysis

Here we begin by creating start and end dates using pythons datetime module.

start = dt.datetime(2021, 1, 1) end = dt.datetime.now() start, end

Select the stocks/tickers you would like to analyse

For Australian stocks, yahoo tickers require ‘.AX’ to be specified at the end of the ticker symbol. For other tickers, use the search bar in yahoo finance to work out other ticker structures. https://au.finance.yahoo.com/

stockList = ['CBA', 'NAB', 'WBC', 'ANZ','WPL'] stocks = ['^AXJO'] + [i + '.AX' for i in stockList] stocks

Using Pandas_Datareader

Two ways of doing this:

- pdr.DataReader(stocks, ‘yahoo’, start, end)

- pdr.get_data_yahoo(stocks, start, end)

df = pdr.get_data_yahoo(stocks, start, end) log_returns = np.log(df.Close / df.Close.shift(1)).dropna() log_returns.head()

Option 1: Directly calculate beta

\(\frac{covariance(Market, Stock)}{variance(Market)}\)

def calc_beta(df):

np_array = df.values

# Market index is the first column 0

m = np_array[:,0]

beta = []

for ind, col in enumerate(df):

if ind > 0:

# stock returns are indexed by ind

s = np_array[:,ind]

# Calculate covariance matrix between stock and market

covariance = np.cov(s,m)

beta.append( covariance[0,1]/covariance[1,1] )

return pd.Series(beta, df.columns[1:], name='Beta')

calc_beta(log_returns)

Option 2: Use linear regression

def regression_beta(df):

np_array = df.values

# Market index is the first column 0

m = np_array[:,0]

beta = []

for ind, col in enumerate(df):

if ind > 0:

s = np_array[:,ind] # stock returns are column one from numpy array

beta.append( stats.linregress(m,s)[0] )

return pd.Series(beta, df.columns[1:], name='Beta')

regression_beta(log_returns)

Option3: Use Matrix Algebra

For linear regression on a model of the form \(y=X\beta\), where X is a matrix with full column rank, the least squares solution,

\(\hat{\beta} = arg \min ||X\beta−y||_2 \)

\(\hat{\beta} = (X^T X)^{−1}X^Ty \)

https://stats.stackexchange.com/questions/23128/solving-for-regression-parameters-in-closed-form-vs-gradient-descent/23132#23132

def matrix_beta(df):

# Market index is the first column 0

X = df.values[:, [0]]

# add an additional column for the intercept (initalise as 1's)

X = np.concatenate([np.ones_like(X), X], axis=1)

# Apply matrix algebra for linear regression model

beta = np.linalg.pinv(X.T @ X) @ X.T @ df.values[:, 1:]

return pd.Series(beta[1], df.columns[1:], name='Beta')

beta = matrix_beta(log_returns)

Define your Portfolio and make DataFrame

Calculate Beta Weighted Portfolio

units = np.array([100, 250, 300, 400, 200])

ASXprices = df.Close[-1:].values.tolist()[0]

price = np.array([round(price,2) for price in ASXprices[1:]])

value = [unit*pr for unit, pr in zip(units, price)]

weight = [round(val/sum(value),2) for val in value]

beta = round(beta,2)

Portfolio = pd.DataFrame({

'Stock': stockList,

'Direction': 'Long',

'Type': 'S',

'Stock Price': price,

'Price': price,

'Units': units,

'Value': units*price,

'Weight': weight,

'Beta': beta,

'Weighted Beta': weight*beta

})

Portfolio

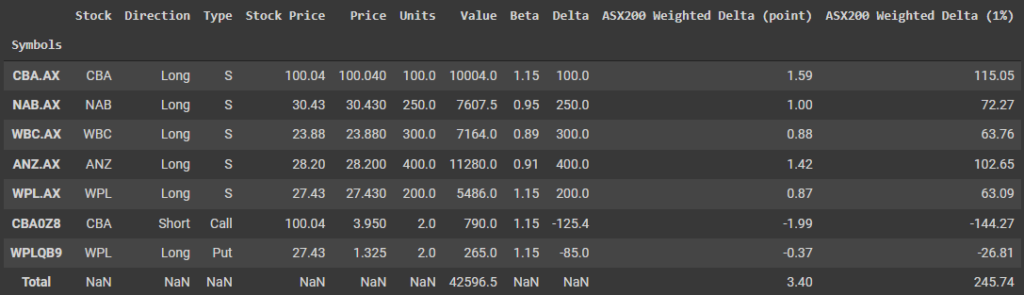

What if we have options, let’s consider things in terms of Delta

Portfolio = Portfolio.drop(['Weight', 'Weighted Beta'], axis=1) Portfolio['Delta'] = Portfolio['Units']

Add options to the portfolio, this is Only an example.

Options = [{'option':'CBA0Z8', 'underlying':'CBA', 'price':3.950, 'units': 2, 'delta': 0.627, 'direction': 'Short', 'type': 'Call'},

{'option':'WPLQB9', 'underlying':'WPL', 'price':1.325, 'units': 2, 'delta': -0.425 ,'direction': 'Long', 'type': 'Put'}]

for index, row in enumerate(Options):

Portfolio.loc[row['option']] = [row['underlying'], row['direction'], row['type'], Portfolio.loc[row['underlying']+'.AX', 'Price'],

row['price'], row['units'], row['price']*row['units']*100, beta[row['underlying']+'.AX'],

(row['delta']*row['units']* 100 if row['direction'] == 'Long' else -row['delta']*row['units']*100)]

Portfolio

Weight the Delta’s using Beta

Portfolio['ASX200 Weighted Delta (point)'] = round(Portfolio['Beta'] * (Portfolio['Stock Price']/ASXprices[0]) * Portfolio['Delta'],2) Portfolio['ASX200 Weighted Delta (1%)'] = round(Portfolio['Beta'] * (Portfolio['Stock Price']) * Portfolio['Delta'] * 0.01,2) Portfolio

Total the Delta’s to get Portfolio Overview

Portfolio.loc['Total', ['Value', 'ASX200 Weighted Delta (point)', 'ASX200 Weighted Delta (1%)']] \ = Portfolio[['Value','ASX200 Weighted Delta (point)', 'ASX200 Weighted Delta (1%)']].sum() Portfolio