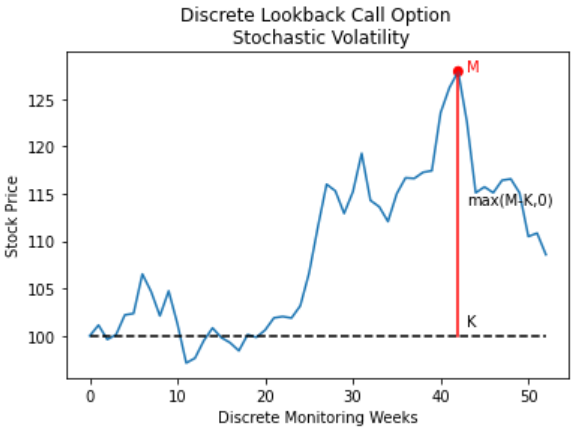

In this tutorial we are pricing a discretely monitored lookback call option with stochastic volatility. The option payoffs are dependent on the extreme values, maximum or minimum, of the underlying asset prices over a certain time period (lookback period). There are two standard lookback options: fixed strike and floating strike. Fixed strike discrete lookback option options pay the difference (if positive) between the max or min of a set of observations, over a lookback period of the asset price and the strike price at the maturity date.

There is no analytical solution for the price of European fixed strike lookback call options with discrete fixings and stochastic volatility under Heston model. However there is a simple analytical formula for the price of a continuously monitored (fixing) fixed strike lookback call with constant volatility.

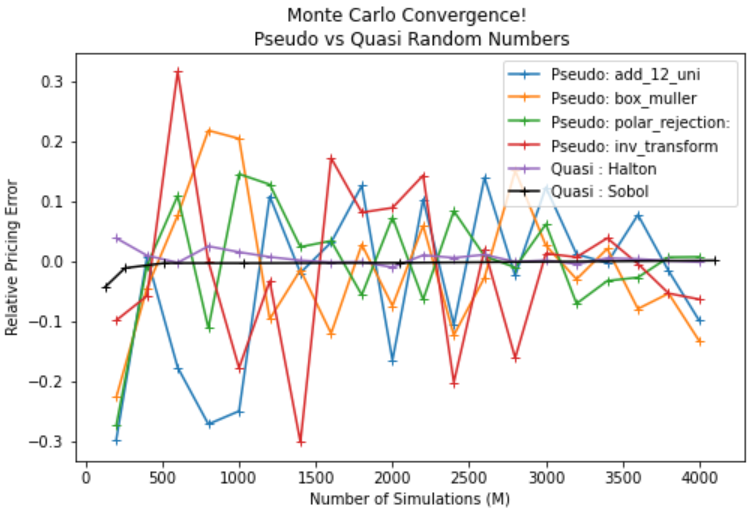

We will use a combination of Monte Carlo Variance Reduction techniques such as antithetic and control variate methods to reduce the standard error of our simulation. We use the analytical solution for a continuously monitored fixed strike lookback call option to calculate control variates based on delta, gamma and vega sensitivities.