Trading Hypothesis: If Interest Rates Rise, Technology Companies valuations will be impacted worse than the broader stock market.

Why? – You should complete your own historical analysis on market analysts deflation on valuations of different company sectors based on historical rate hikes.This is not investment advice! But let’s say I do my research and I conclude:

Technology companies are more sensitive to interest rates due to the influence of current DCF valuations based on the expectation of high growth rates in free cash flow in the future.

How could I benefit from this view?

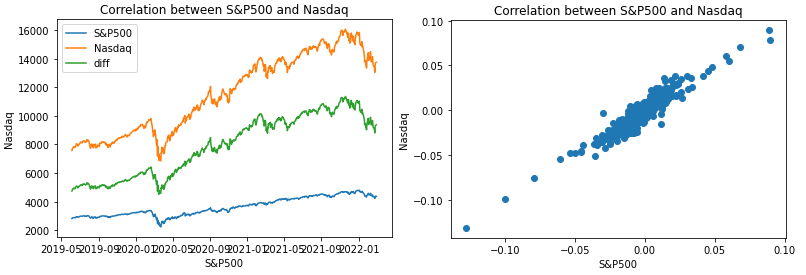

The NASDAQ-100 Index is heavily weighted to the technology sector. The S&P 500 Index, by contrast, is recognized as having a broad, diversified constituency and represents the broad market. What makes this type of trade possible is both of these indices, while slightly different, have a high degree of price correlation.

import numpy as np

import pandas as pd

import datetime as dt

import matplotlib.pyplot as plt

from pandas_datareader import data as pdr

def get_data(stocks, start, end):

stockData = pdr.get_data_yahoo(stocks, start, end)

stockData = stockData['Close']

log_returns = np.log(stockData) - np.log(stockData.shift(1))

covMatrix = log_returns.cov()

corMatrix = log_returns.corr()

return stockData, log_returns, covMatrix, corMatrix

indices = ['^GSPC', '^IXIC']

endDate = dt.datetime.now()

startDate = endDate - dt.timedelta(days=1000)

prices, log_returns, covMatrix, corMatrix = get_data(indices, startDate, endDate)

prices['diff'] = prices['^IXIC'] - prices['^GSPC']

plt.plot(prices)

plt.title('Correlation between S&P500 and Nasdaq')

plt.xlabel('S&P500')

plt.ylabel('Nasdaq')

plt.legend(['S&P500', 'Nasdaq', 'diff'])

plt.show()

print('stats\n',prices.describe(), '\n\nlast price diff',prices['diff'][-1])

df = prices['diff']

normalized_df=(df-df.mean())/df.std()

# to use min-max normalization:

mm_normalized_df=(df-df.min())/(df.max()-df.min())

# plt.plot(normalized_df)

plt.figure(figsize=(12,6))

plt.plot(mm_normalized_df)

plt.scatter(log_returns['^GSPC'], log_returns['^IXIC'])

plt.title('Correlation between S&P500 and Nasdaq')

plt.xlabel('S&P500')

plt.ylabel('Nasdaq')

plt.show()

print('Index Correlation: ', corMatrix)

print('Index Covariance to Volatilty: ', np.sqrt(covMatrix)*np.sqrt(252))

print('Index Volatility: ', np.std(log_returns)*np.sqrt(252))

Trading Opportunities in Equity Index Futures

https://www.cmegroup.com/education/whitepapers/stock-index-spread-opportunities.html

In order to construct this spread between Index Futures, we must first calculate a Spread Ratio. The spread ratio is defined as the notional value of one index future divided by the notional value of another.

In this case, we will divide the notional value of the NASDAQ-100 futures by the notional value of the S&P 500 futures.

Executing the Trade

Example: A portfolio manager (PM) believes the tech sector is at risk versus the broad market. He is willing to express this opinion with a $10 million equivalent risk position, leading the PM to take the following actions:

- The PM sells the E-mini NASDAQ-100/E- mini S&P 500 spread

# Parameters

SP500 = 4373.94

NASD = 13751.40

emini_SP500_x = 50 # $50 per point

emini_NASD_x = 20 # $20 per point

emini_SP500 = SP500*emini_SP500_x

emini_NASD = NASD*emini_NASD_x

spread_ratio = emini_NASD/emini_SP500

print('Notational Value of E-mini S&P500: ', round(emini_SP500,0))

print('Notational Value of E-mini NASDAQ: ', round(emini_NASD,0))

print('Spread Ratio: ', round(spread_ratio,2))

print('Portfolio Postion: $', 10000000,'\n')

print('Short Postion in E-mini NASDAQ: ', int(10000000/emini_NASD))

print('Long Position in E-mini S&P500: ', int(spread_ratio*10000000/emini_NASD))

OTHER OPTION: OTC Spread Options on Indices

One of the main uses of Monte Carlo simulation is for pricing options under multiple stochastic factors.

Pricing options whose pay-off depends on multiple asset prices, or with stochastic volatility. Let’s consider a European spread option on the difference between two assets (stock indices) $S_1$ and $S_2$ which follow a GBM process.

$dS_1 = (r-\delta_1)S_1dt + \sigma_1S_1dz_1$

$dS_2 = (r-\delta_2)S_2dt + \sigma_2S_2dz_2$

# Parameters SP500 = 4373.94 NASD = 13751.40 div_SP500 = 0.0127 div_NASD = 0.0126 vol_SP500 = 0.143050 vol_NASD = 0.194692 K = 9377 # current difference between index points T = 1 r = 0.01828 # 10yr US Treasury Bond rho = 0.922323 # correlation N = 1 # discrete time steps M = 1000 # number of simulations

Slow Steps

# Precompute constants

dt = T/N

S1 = NASD

S2 = SP500

nu1dt = (r - div_NASD - 0.5*vol_NASD**2)*dt

nu2dt = (r - div_SP500 - 0.5*vol_SP500**2)*dt

vol1sdt = vol_NASD*np.sqrt(dt)

vol2sdt = vol_SP500*np.sqrt(dt)

srho = np.sqrt(1-rho**2)

# Standard Error Placeholders

sum_CT = 0

sum_CT2 = 0

# Monte Carlo Method

for i in range(M):

St1 = NASD

St2 = SP500

for j in range(N):

dz1 = np.random.normal()

dz2 = np.random.normal()

z1 = dz1

z2 = rho*dz1 + srho*dz2

St1 = St1*np.exp(nu1dt + vol1sdt*z1)

St2 = St2*np.exp(nu2dt + vol2sdt*z2)

CT = max(0, K - (St1 - St2))

sum_CT = sum_CT + CT

sum_CT2 = sum_CT2 + CT*CT

# Compute Expectation and SE

C0 = np.exp(-r*T)*sum_CT/M

sigma = np.sqrt( (sum_CT2 - sum_CT*sum_CT/M)*np.exp(-2*r*T) / (M-1) )

SE = sigma/np.sqrt(M)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0,2),np.round(SE,2)))

Fast Solution

# Precompute constants

N=100

dt = T/N

S1 = NASD

S2 = SP500

nu1dt = (r - div_NASD - 0.5*vol_NASD**2)*dt

nu2dt = (r - div_SP500 - 0.5*vol_SP500**2)*dt

vol1sdt = vol_NASD*np.sqrt(dt)

vol2sdt = vol_SP500*np.sqrt(dt)

srho = np.sqrt(1-rho**2)

# Monte Carlo Method

dz1 = np.random.normal(size=(N, M))

dz2 = np.random.normal(size=(N, M))

Z1 = dz1

Z2 = rho*dz1 + srho*dz2

delta_St1 = nu1dt + vol1sdt*Z1

delta_St2 = nu2dt + vol2sdt*Z2

ST1 = S1*np.cumprod( np.exp(delta_St1), axis=0)

ST2 = S2*np.cumprod( np.exp(delta_St2), axis=0)

ST1 = np.concatenate( (np.full(shape=(1, M), fill_value=S1), ST1 ) )

ST2 = np.concatenate( (np.full(shape=(1, M), fill_value=S2), ST2 ) )

CT = np.maximum(0, K - (ST1[-1] - ST2[-1]))

C0 = np.exp(-r*T)*np.sum(CT)/M

sigma = np.sqrt( np.sum( (np.exp(-r*T)*CT - C0)**2) / (M-1) )

SE= sigma/np.sqrt(M)

print("Call value is ${0} with SE +/- {1}".format(np.round(C0,2),np.round(SE,3)))